Markets were poised for a positive start on Monday as investors look to avoid any June gloom.

Here are 4 things you need to know before the bell:

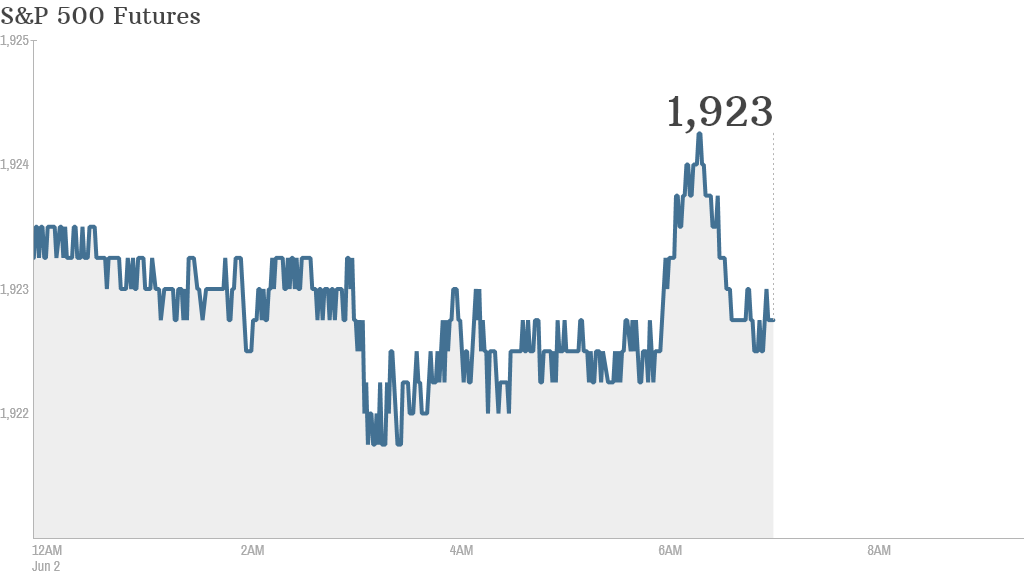

1. Market direction: U.S. stock futures were slightly higher Monday ahead of the first trading session since investors closed out the record-setting month of May.

On Friday, U.S. stocks eked out gains and the Dow Jones industrial average and S&P 500 closed the week at all time highs.

Over the past month, the Nasdaq surged by just over 3%, the S&P 500 rose by 2.1% and the Dow added 0.8%.

Since the start of the year, the Nasdaq has had a bumpy ride but the Dow and S&P have pushed higher in four of the last five months.

The main market mover Monday was Salesforce.com (CRM). Shares were rising ahead of the opening bell. Last week the company announced a strategic partnership with Microsoft (MSFT).

2. Positive data from China: A reading of manufacturing activity in China released over the weekend showed the country's factory sector continued to strengthen after a rough start to the year.

The data has boosted investor confidence, but not everyone was able to react to the news since a handful of Asian markets were closed for a holiday. The Nikkei in Japan surged by just over 2%.

Related: Fear & Greed Index: idling in neutral

3. Economic data and earnings: The U.S. government will release data on April construction spending at 10 a.m. ET. The ISM index, which measures the manufacturing industry each month, will be published at the same time.

Hertz Global (HTZ), Krispy Kreme (KKD) and Quicksilver (ZQK) will report earnings after the closing bell.

4. International movements: European markets were slightly higher in midday trading, with the FTSE 100 in London and the Dax 30 in Germany outpacing CAC 40 in France.

The main stock market index in Spain was rising by roughly 0.6%, with investors unfazed by news that King Juan Carlos is abdicating. Markets were more interested in weekend news of an economic stimulus package, including a cut in the corporate tax rate to 25% from 30%.