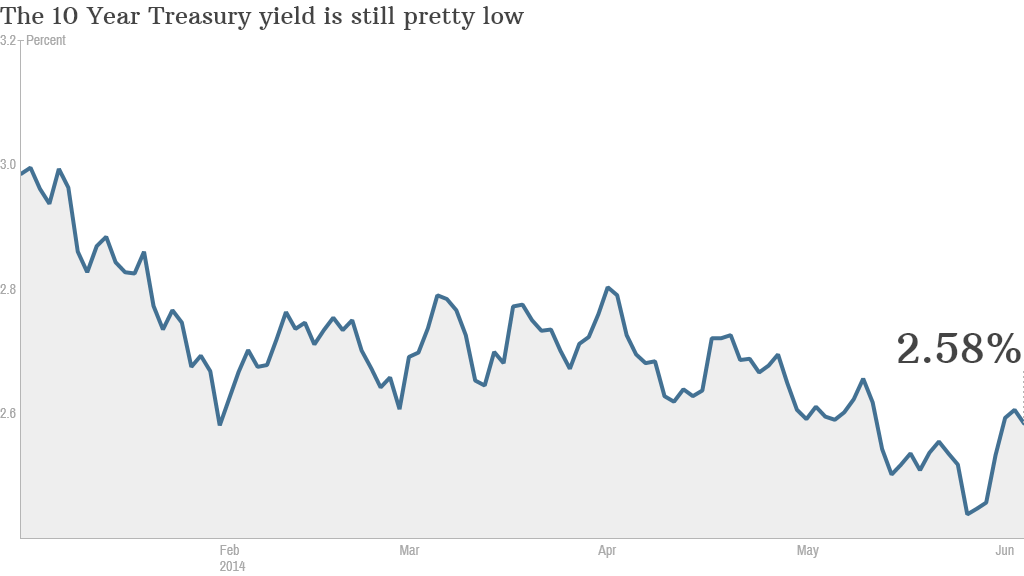

Persistently low interest rates in the United States are forcing bond investors to don their hunting caps and scour the globe for higher yields.

Even though the yield on the benchmark 10 Year Treasury note has crept up recently, it's still a paltry 2.56%. So investors looking for better returns are venturing into riskier territory to find them.

Here's where their quest for higher yield is taking them.

Emerging markets: It might seem crazy to delve back into emerging market debt after its brutal selloff earlier in the year. But that's just what Jack McIntyre, who manages $43 billion in bonds for Brandywine Global in Philadelphia, is doing.

He owns bonds of Brazil, Indonesia, and South Africa -- three of the so-called "Fragile Five" economies that analysts became deeply concerned about late last year and earlier this year.

McIntyre owns Brazilian 10 Year bonds that yield over 12%. While he admits Brazil has real economic problems that could become even more apparent when the country hosts the World Cup this month, he argues that accelerating growth in developed economies such as the United States, Europe and Japan will eventually trickle down to the emerging world.

Related: Americans finally want World Cup tickets

Corporate junk: As their name implies, these are the high yielding bonds of companies with below investment grade credit ratings. With an average yield of 5.7%, the potential returns are lucrative, so long as the company doesn't default.

Investors poured roughly $5.5 billion into corporate junk bond funds this year through May 28th, compared to just $1.6 billion over the same period last year, according to data from Lipper.

In April, French telecommunications giant Numericable pulled off the largest sale of junk bonds in history -- a nearly $11 billion offering. Other mega junk bond deals this year came from Community Health Systems (CYH), Icahn Enterprises (IEP), and Chesapeake Energy (CHK). Those companies all sold more than $3 billion worth of bonds, according to S&P Capital IQ.

Related: S&P slaps junk bond rating on Tesla debt

Puerto Rico: The financially-strapped Caribbean island held a mega $3.5 billion bond sale in March offering an 8% yield, Hedge funds gobbled up the deal. despite the fact that Puerto Rico has over $70 billion in debt and had its credit rating cut to junk status in February. Still, betting on Puerto Rico has paid off, with the S&P Municipal Bond Puerto Rico Index returning an impressive 10.3% so far this year.

Subprime mortgages: After the financial crisis, the very thought of subprime mortgages would send some investors running for the hills. But Robert Tipp, who manages $400 billion as chief investment strategist for Prudential Fixed Income, thinks there is a great opportunity in the market because of their bad reputation,

Related: Subprime mortgages making a comeback

He's investing in high quality slices of residential mortgage-backed securities, which yield around 1% to 2% above comparable Treasuries. While the underlying mortgages originated from subprime home borrowers, Tipp claims that many of these loans have actually performed pretty well over time.

You just need to do your homework. Tipp says if you know how to analyze subprime mortgage backed securities properly, the risk of losing your principal is actually very low.

"The [subprime mortgage] name is tainted, but that doesn't mean we can't find things that we are very comfortable with," he said.