In food terms, stocks could be compared to burgers and fried chicken and bonds would be more like salad. These days, investors are especially hungry for a certain type of salad -- the kind loaded with blue cheese dressing and bacon.

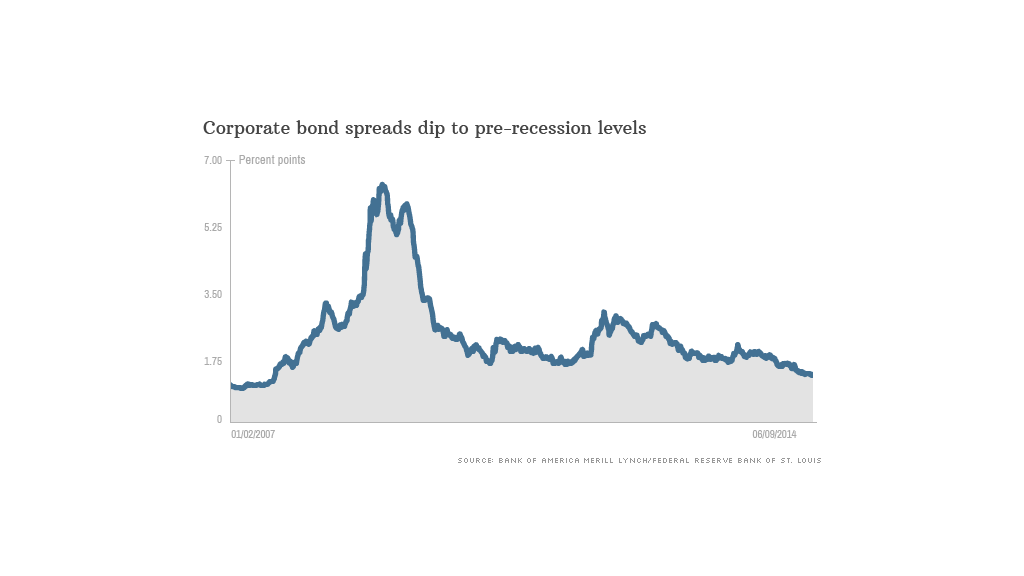

Corporate bonds are in high demand. Investors are practically trampling one another to buy them. One measure of the appetite for these bonds is the "spread," or difference in bond yields between corporate bonds (often seen as somewhat risky) and 10-year Treasury notes (one of the safest investments).

The spread has narrowed to rates not seen since July 2007 -- before the financial crisis -- according to Bank of America Merrill Lynch.

It's a sign that companies are borrowing a lot of money, and that investors don't view corporate debt as particularly risky right now. The spread is 125 basis points. That means investors only want an extra 1.25% when they buy corporate debt versus plain vanilla U.S. government debt.

Companies are taking advantage of this.

An explosion of corporate debt: American companies issued a record $1.4 trillion last year in so-called "junk" debt, some of the riskiest corporate bonds. That was nearly double the amount sold in 2008.

One of the seven indicators that make up CNNMoney's Fear & Greed Index is junk bond demand. The index currently reads "extreme greed," reflecting the strong appetite for junk bond debt.

Corporate bond issuance overall surpassed pre-recession records two years ago, according to data from Securities Industry and Financial Markets Association, a financial industry trade group.

Related: Check out some of the other places investors are looking for yield.

Low interest rates from central banks around the world make borrowing and refinancing old debt attractive right now. Much like home buyers, companies have sought to lock in long-term rates at low, fixed interest rates.

"The companies don't have a lot of short-term debt coming due," said Mark Kiesel, deputy CIO and head of global bond portfolio management for bond giant Pimco. "A lot of their debt is fixed, and it's longer out."

So what are companies spending all this money on? Much of it is going to finance higher dividends and share buybacks. Some debt is being used to pay for mergers and acquisitions.

For example, Apple (AAPL) sold a then-record $17 billion of bonds last year and used the money for a dividend increase to quiet investors who wanted to see its massive overseas cash hoard put to use.

Verizon (VZ) crushed Apple's record a few months later with a $49 billion issuance to help pay for its $130 billion purchase of Vodafone's (VOD) half-stake in Verizon Wireless.

Related: Companies splurge on buying biotechs

Concerns about corporate debt: At the moment, investors aren't worried about the surge of corporate bonds. The big problems before the credit crisis were a result of the various credit derivative products that got the financial system -- and the world economy -- into trouble.

Those products don't exist at nearly the same levels today.

But there is one concern: Yield hunters are looking further afield from safer investment grade bonds to less liquid, so-called "junk" bonds without investment grade ratings, says Jody Lurie, corporate credit analyst for Janney Capital Markets.

"The problem we're running into now is that investors who are not used to that level of risk are going into companies with more risk," she notes.

She warns that investors must be prepared for the corporate bond market to rapidly turn against them.