Oil prices are stealing the show again Friday as markets close out a rough week. Central banks were in action too.

Here are the six things you need to know before the opening bell rings:

1. Iraq concerns propel oil prices: Crude oil prices continue to trade at nine-month highs, pushing higher by roughly 1% to above $107 per barrel, as commodity traders worry about increasing instability in Iraq. Large areas of the country have been overrun by militants, raising fears that oil production and exports could be hit.

Oil prices were last this high in September 2013. On Thursday, oil jumped by more than 2%.

Gold prices rallied by over $10 Thursday but were flat Friday at $1,274 per ounce. Gold tends to rise in turbulent times as investors seek safe havens.

2. Central bank action moves markets: The pound climbed against the dollar to its highest level in years after the head of the Bank of England said overnight that U.K. interest rates could rise sooner than markets expect. That could mean a rate rise as early as the end of 2014.

Steven Englander, managing director at CitiFX, said the warning would turn the spotlight back on policymakers at the U.S. Federal Reserve.

"Investors [will] look to next week's Federal Open Market Committee [meeting] as a guide to whether the Fed sees itself beginning the road to normalizing policy or engaged in an ongoing effort to avoid normalization for as long as possible. We think the FOMC and Janet Yellen will maintain their highly dovish stance," he said.

In Asia, the Bank of Japan kept its monetary policy unchanged.

Related: Fear & Greed Index still extremely greedy

3. Stock market movers -- Intel, Google: Intel (INTC)shares were powering forward by roughly 5% in premarket trading after the company announced a more positive outlook for the second quarter.

Google (GOOG) shares were under a bit of pressure, declining by roughly 1%.

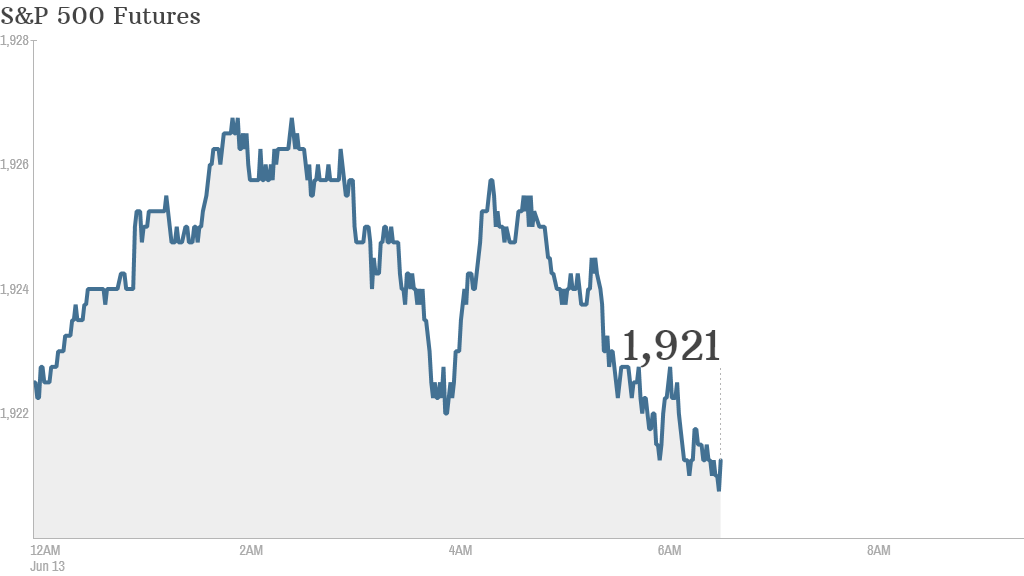

4. U.S. stocks edging up: U.S. stock futures were slightly lower ahead of the open.

The Dow Jones industrial average, S&P 500 and the Nasdaq all fell Thursday, adding to Wednesday's losses.

5. Economic announcements: At 8:30 a.m. ET, the U.S. Bureau of Labor Statistics will release May's Producer Price Index, which measures the cost of producing goods. At 9:55 ET, the University of Michigan will release its reading on consumer sentiment for June.

6. International action: European markets were all declining in midday trading. London's FTSE 100 led the way with a drop of more than 1%.

Asian markets ended with mixed results.