Move to the Deep South and chances are high that disaster will strike your home sooner or later.

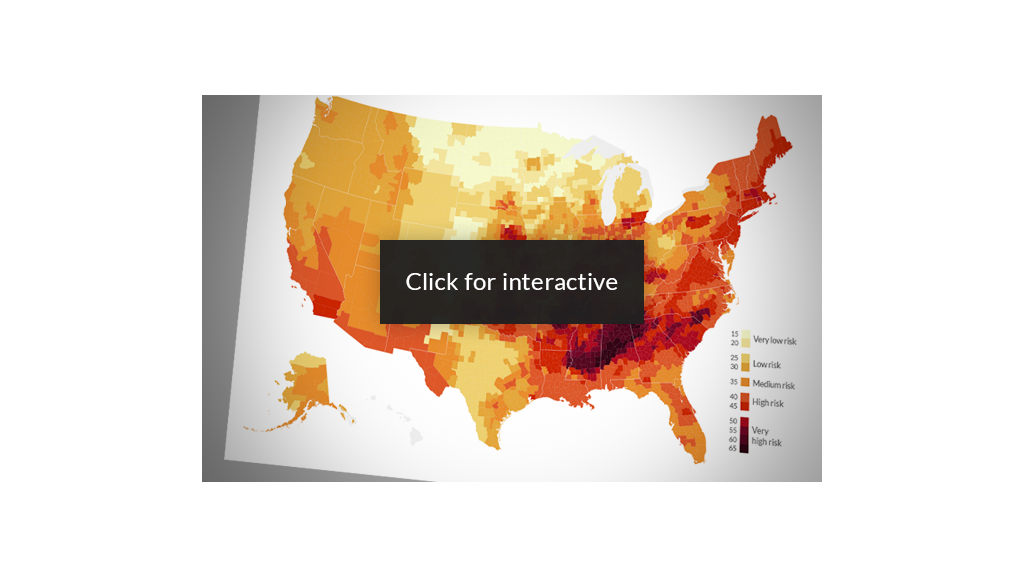

Alabama, Georgia and Mississippi boast the dubious distinction of having the highest risk of getting hit by a natural disaster -- whether it be a tornado, earthquake or hurricane, according to RealtyTrac, which analyzed data from the U.S. Geological Survey (USGS) and the National Oceanic and Atmospheric Administration (NOAA) to assess natural disaster risk for more than 3,000 U.S. counties.

In Alabama's Jefferson and Tuscaloosa counties, for example, tornadoes are seven times more likely to occur than the average U.S. county. The last huge tornado, a multi-vortex, hit three years ago causing 64 fatalities and $2.4 billion in damage.

Not only that, but hurricanes are another threat to the region. And that double whammy means premiums for property insurance can be much more expensive. Alabama's average homeowner's policy cost more than $1,100 a year versus a little more than $500 a year for Idaho, where insurance is the cheapest, according to the National Association of Insurance Commissioners.

Related: Damaged home? How to get an insurer to pay up

RealtyTrac reported that 55% of homes in the U.S. are either in "very high" or "high" risk zones.

"The potential risk of a natural disaster may not be the first item on most homebuyer checklists for a dream home, but prudent buyers will certainly take this into consideration," said Daren Blomquist, vice president at RealtyTrac.

As those who lost homes in Superstorm Sandy discovered, one major storm can be costly.

Sandy hit in 2012, killing 48 people and causing $32 billion in damage in New York State, most of it in New York City's five counties.

People who have rebuilt or bought homes in the hardest hit areas are facing sky-high flood insurance premiums of as much as $10,000 or more.

Finding a home that lasts

When buying a home in a hurricane-prone area check out the home's quality of construction and its ability to withstand a storm, said Blomquist.

Houses built in flood zones should be built on pilings high off the ground so storm surge waters can flow beneath without damaging the upper parts of the home.

Related: Dream beach homes for sale

With homes built in areas with high earthquake activity, like California, pay attention to how the home is framed and what can happen to some architectural details during an earthquake.

There's not too much one can do to withstand a fierce tornado but storm shelters can at least increase the odds of surviving a storm, even if your house does not.

Want to avoid all of these natural disasters altogether? Try moving to Minnesota or Montana. RealtyTrac reported that 23% of homes were located in medium risk counties while 22% were in low or very low risk counties.

Three of the four lowest risk counties are in Minnesota, outside Minneapolis, and on the prairie lands of Montana, around Billings. In these places, the biggest risk may be frost bite or bursting a water pipe.