Major global stock markets were in negative territory Wednesday, setting the stage for what could be another poor showing in the U.S.

Here are the six things you need to know to start the trading day:

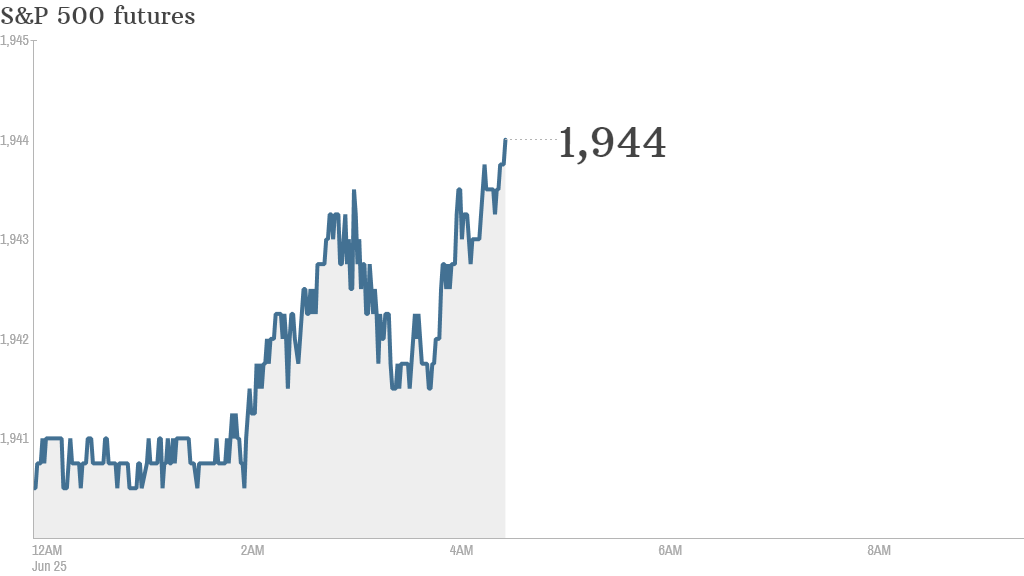

1. Stocks in the red: U.S. stock futures were relatively weak following a day of steep losses on Tuesday.

During the previous session, the Dow Jones Industrial Average shed 119 points, its biggest one-day percentage drop in more than a month. The S&P 500 and the Nasdaq both fell as well.

All major European markets were lower by about 0.5% Wednesday. Asian markets ended in negative territory.

2. Brace yourself for U.S. GDP figures: Market sentiment could be influenced ahead of the opening bell when the Commerce Department releases revised first quarter GDP numbers at 8:30 a.m. ET. The first estimate indicated that the U.S. economy shrank in the first quarter, and economists expect the revision to show an even deeper slump.

Briefing.com predicts the revision will indicate the economy contracted at a -1.8% annual rate. Any number worse than -1.3% will be the single worst quarter for the U.S. economy since the Great Recession.

3. Stocks to watch -- Vodafone, Blackberry, Tesla: Vodafone (VOD) and BlackBerry (BBRY) shares were under a bit of pressure ahead of the open. Tesla (TSLA) shares were gaining some traction.

4. Earnings expectations: Investors will get quarterly results from Barnes and Noble (BKS), General Mills (GIS) and Monsanto (MON) ahead of the opening bell. Bed Bath and Beyond (BBBY) will report after the close.

5. Dubai markets bounce back: Dubai stock markets suffered a sharp tumble to start the week, as concerns about continued turmoil in Iraq damaged investor confidence. However, the benchmark Dubai Financial General Market Index recovered about 5% on Wednesday.

6. Russian markets decline, again: Russia's main Micex index declined by nearly 1% on reports that the West might slap more sanctions on Russia.

The Micex has been on a wild ride this year, dropping by over 20% and then fully recovering as worries about the Ukraine crisis and sanctions intensified and then receded.