Good news for the global economy could set the tone for markets Wednesday after China turned in a stronger than expected performance in the second quarter.

"Chinese GDP came in better than expected, which diminishes the fear factor of the global economy faltering," said Peter Cardillo, chief market economist at Rockwell Global Capital.

Here are the four things you need to know before the opening bell rings in New York:

1. China GDP: The world's second biggest economy grew by 7.5% compared with the same period last year, despite continued worries about a slowdown in real estate. It was the first time the economy has accelerated in three quarters, putting China on a somewhat better footing to reach its official growth target of 7.5% for 2014.

2. Earnings roll in: After JPMorgan (JPM) and Goldman Sachs (GS) both beat expectations with their quarterly reports Tuesday, it's Bank of America (BAC)'s turn to publish earnings before the opening bell Wednesday.

PNC (PNC) reported a quarter-to-quarter slip in net income.

eBay (EBAY) will report after the close.

Related: Fear & Greed Index back to extreme greed

3. Stock market movers -- Time Warner, Intel, IBM, Apple, Yahoo: Time Warner (TWX) shares surged 14% in premarket trading following a New York Times report that Rupert Murdoch's 21st Century Fox (FOXA)made a $80 billion bid for the media company in recent weeks but was rebuffed. (Time Warner is the parent company of CNNMoney.)

Shares of Intel (INTC) rose by nearly 5% premarket after the company posted earnings that beat expectations and announced plans to boost its share repurchase program by $20 billion. Shares of both IBM (IBM) and Apple (AAPL) were also nearly 2% firmer in premarket trading after they announced they would join forces to offer iPhones and iPads preloaded with special software developed by IBM.

Yahoo (YHOO) was heading in the opposite direction, falling more than 2% premarket after second quarter revenue and profits missed forecasts.

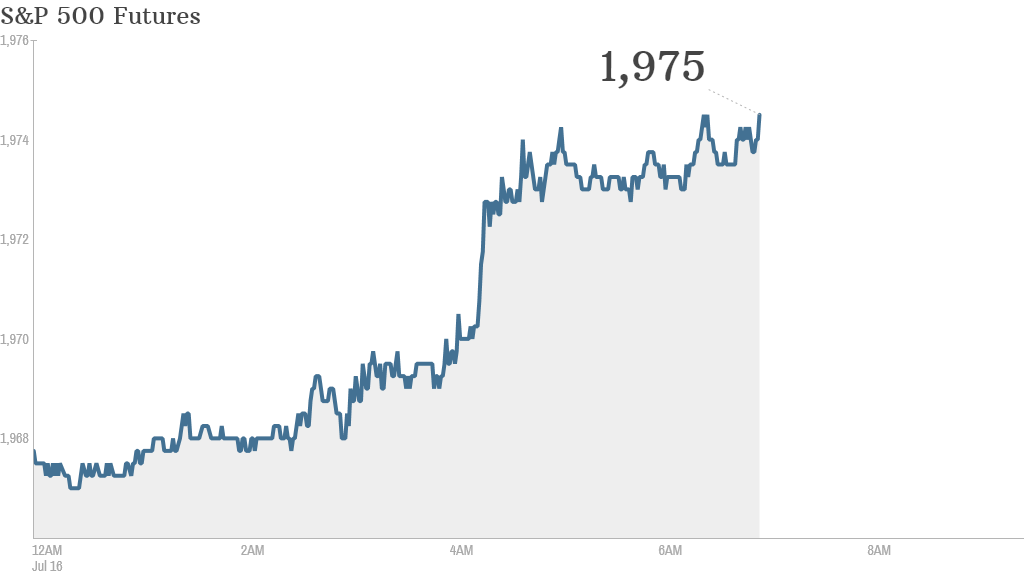

4. Market overview: European markets bounced about 1% higher, encouraged by China's growth figures, and U.S. stock futures were trading about 0.3% firmer.

U.S. stocks closed mixed Tuesday. The Dow Jones industrial average ended about 5 points higher, for its second highest close in history. But the S&P 500 and the Nasdaq ended the day lower after the Federal Reserve warned of a bubble in social media and biotech stocks.

Asian markets were also mainly firmer.