The global stock market rally seems to be gaining steam Tuesday.

Here are the three things you need to know before the opening bell rings in New York:

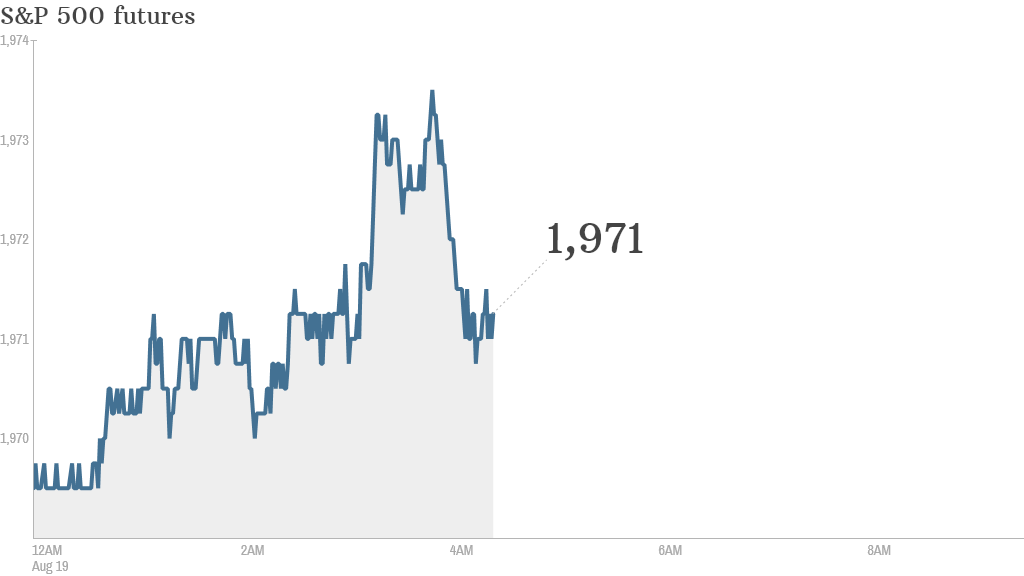

1. Up, up and away: U.S. stock futures were in positive territory and markets across Europe and Asia were all rising.

Worries about the crises in Ukraine and Iraq continue to fade, and CNNMoney's Fear & Greed index is showing investors are much less fearful than last week.

"The geopolitical tensions have vanished from the trader's dashboard as if they never existed," said Naeem Aslam, chief market analyst at foreign exchange broker AvaTrade.

U.S. stocks closed higher Monday. The Dow Jones Industrial Average and the Nasdaq were both up about 1%, while the S&P 500 closed 0.9% higher. The Dow is on track for its best month since February. It's already up over 1.5% in August.

Related: 3 Reasons stocks are still charging ahead

2. Market movers -- BHP Billiton, Chinese media sector: Shares in BHP Billiton (BBL) were falling by nearly 5% premarket after the giant global mining group said it was splitting into two separate companies. The company's website was overwhelmed as investors rushed to read all the details. BHP Billiton was formed through a $30 billion mega-merger in 2001, and the upcoming split will essentially undo the combination.

The Chinese media sector was on a tear Tuesday after China's President Xi Jinping announced plans to strengthen the industry and create credible companies. In Shanghai, shares in Shanghai Xinhua Media and People.cn both rallied by 10%, the maximum allowed in a single day.

3. Economics and earnings: The latest consumer price data show inflation remains largely tame. The U.S. government's consumer price index inched up just 0.1% in July, matching forecasts from economists. Consumer prices were also up only 0.1% when volatile food and energy prices are excluded.

Investors also received encouraging news on the real-estate front. The U.S. Census Bureau said July housing starts jumped 15.7% after shrinking in June.

These latest economic data points nudged futures slightly higher.

On the earnings front, Dick's Sporting Goods (DKS), Home Depot (HD) and TJX (TJX) all reported before the opening bell.