Investing your savings in the right mix of stocks, bonds and other investments is crucial to making your money last throughout your retirement years. But figuring out the right mix -- a.k.a. your asset allocation -- can be tricky.

First, consider your time horizon: How many years are you away from retiring? A 30-year-old, for example, has at least 30-odd years before they leave the workforce, allowing them more time to recover from market swings and other events.

"The more time that you have, then the more risk you're able to take," said Simon Moore, chief investment officer at online investment advisor FutureAdvisor.

Related: 5 big retirement mistakes

To help you determine what percentage of your portfolio should be invested in riskier assets like stocks, one rule of thumb suggests you subtract your age from 120. That means a 30-year-old should invest up to 90% of her portfolio in stocks, while a 50-year-old should opt for up to 70%.

The remainder of the portfolio should be invested in more conservative plays like bonds and money market funds.

Next: Diversify. Make sure both your stock and bond investments are spread among a variety of asset types and classes.

For stocks, that means investing in both international and U.S. markets, including a mix of large, mid-sized and smaller company stocks. Index funds, which mirror overall market movements, can also help diversify your portfolio.

Quiz: What's your risk tolerance?

Vanguard, for example, recommends investing between 20% and 40% of your stock allocation in international markets, and the rest in a mix of U.S. stocks.

Once you have those foundations down, it's time to consider your risk tolerance.

Find out what your stomach for risk is by taking our quiz, then read about the best allocation strategy for you.

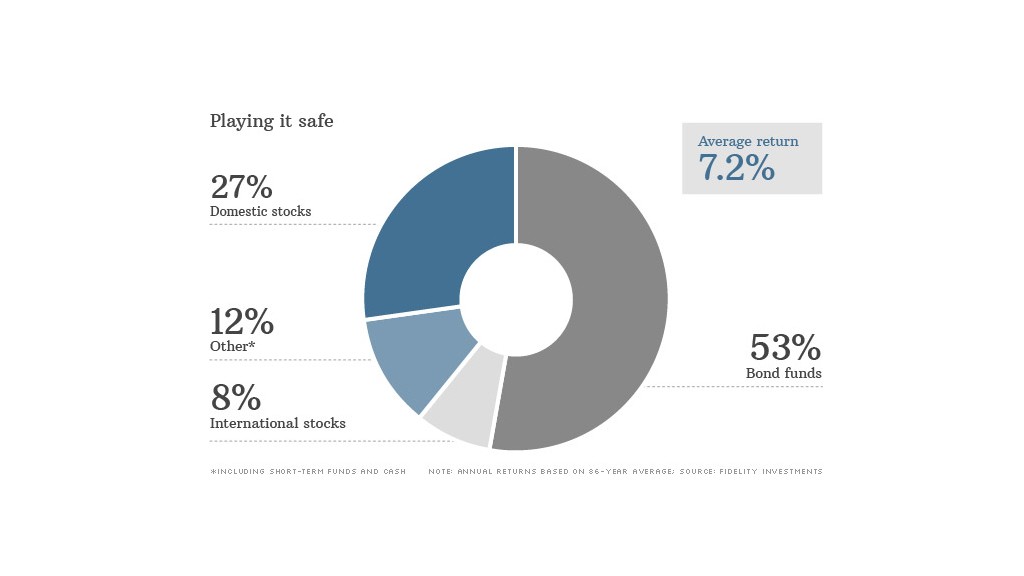

If you like to play it safe: Even if you're close to retirement age or just a conservative investor at heart, there is such a thing as playing it too safe.

Even the most conservative retirees should keep at least 20% of their portfolio in stocks, said Maria Bruno, a senior analyst at Vanguard. Otherwise, your portfolio may shrink too quickly when you start withdrawing funds.

Investors in T. Rowe Price's target date retirement funds, for example, have at least 42% of their money allocated to stocks at the time of retirement.

Related: How much will I need for retirement?

Meanwhile, if you're still several decades away from retirement, you should invest the majority of your portfolio in stocks, no matter how conservative you are. Otherwise, you can run into another threat — the inability to keep up with inflation.

"Cash can be as risky as equities," Bruno said.

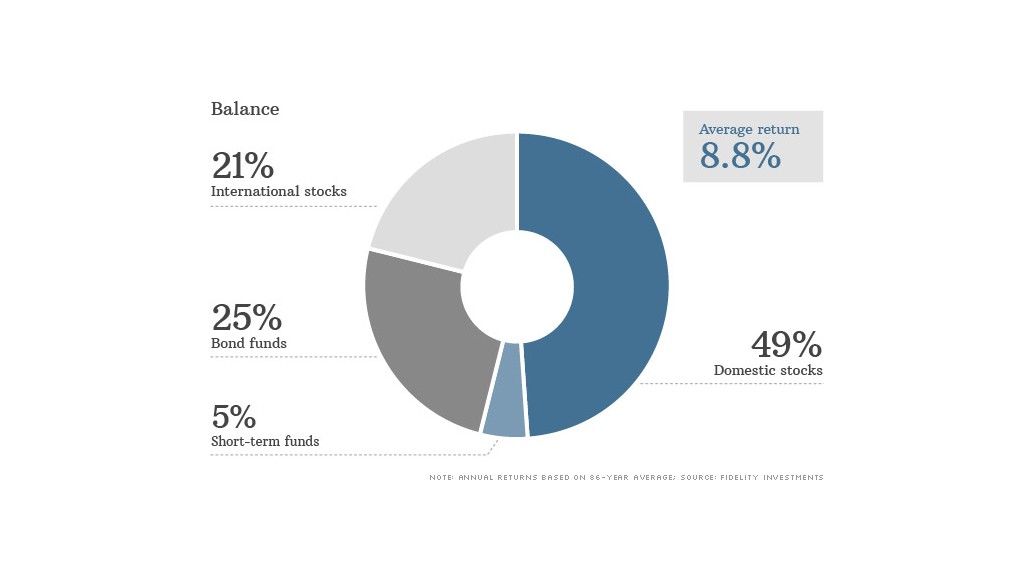

If you crave balance: For a balanced portfolio, diversification is the name of the game.

That means not being overly exposed to any one type of investment, sector or region so you can better stomach market volatility.

Take the 2008 stock market crash: People on the verge of retirement who had a chunk of their investments in bonds lost far less of their savings than those who were overly invested in stocks.

Overwhelmed by all of the options? Consider a target date fund, which invests in a mix of stocks, bonds and cash based on an age-appropriate level of risk. If you'd rather go it alone, you can take a look at different provider's target date options and use their investment mix as a guideline.

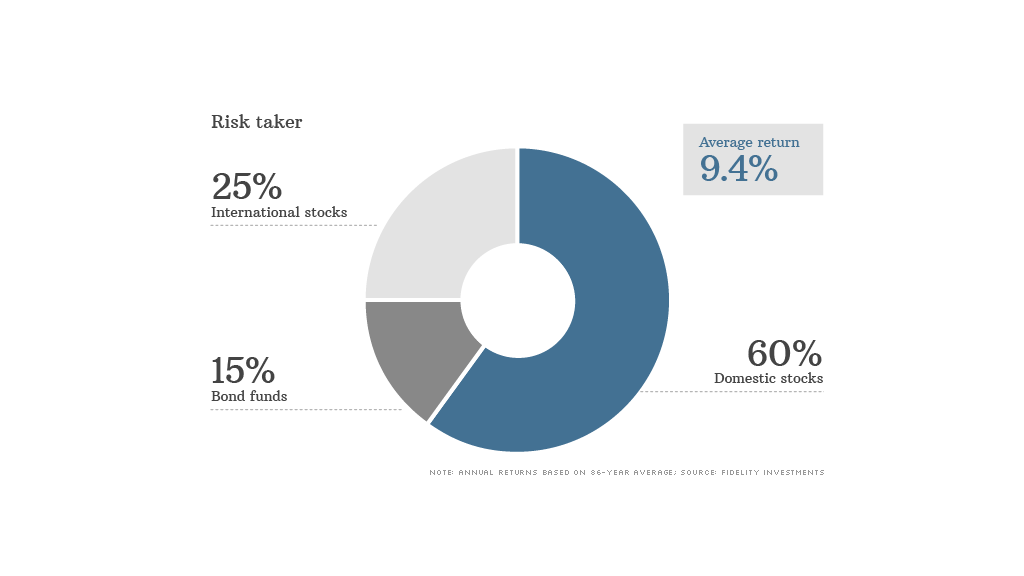

If you're a risk taker: Just because you have a cast iron stomach when it comes to market volatility doesn't mean you should gamble your retirement savings.

Related: The best states to retire in are a little surprising

Investing too much of your portfolio in a single sector or, worse, a single stock, is never a good idea.

If you want to live on the edge, you can invest a bigger chunk of your assets in riskier sectors that also provide the opportunity for higher returns, such as emerging markets, said Jeanne Thompson, a vice president at Fidelity Investments.

For investors looking beyond traditional 401(k) investments, FutureAdvisor recommends investing a small portion of your portfolio in real-estate investment trusts, or REITS, which they say tend to offer a relatively solid return over time and protection against inflation.

But no matter how much of a risk taker you are, you should never have 100% of your investments in stocks. "Regardless of any age, you don't want to take too much risk," Thompson said.