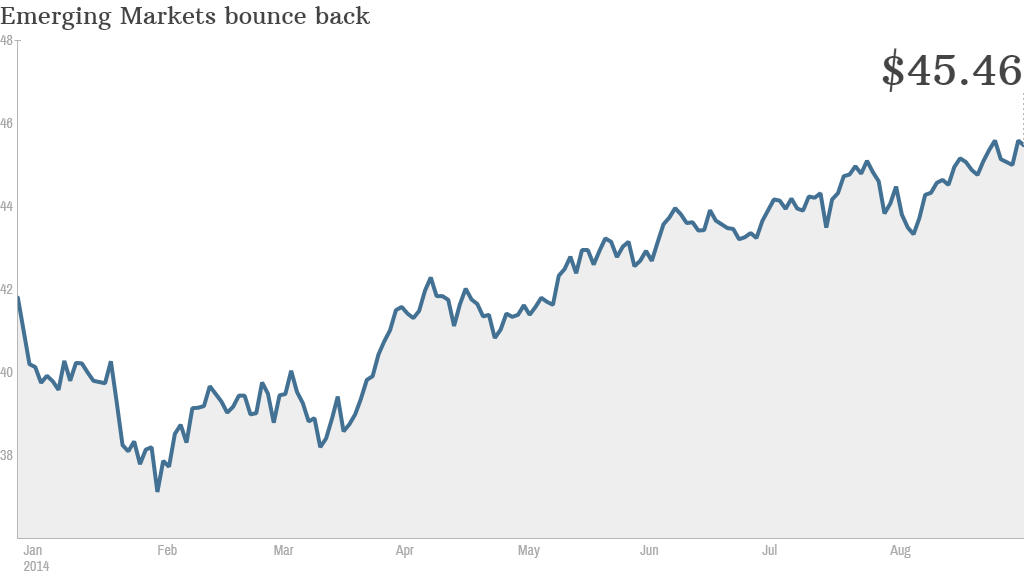

After a long slumber, emerging markets are finally waking up.

The iShares MSCI Emerging Market ETF, (EEM) which tracks the widely-followed benchmark for emerging market stocks, has surged 7% in the last three months, outpacing U.S. markets.

It's hard to recall that at the start of 2014, investors feverishly yanked nearly $11.5 billion from emerging markets funds amidst concerns that countries from China to Brazil were going to tank as the Federal Reserve pulled back its stimulus measures and raised interest rates.

Since then, roughly $13.8 billion has poured into emerging markets funds, according to data from Trim Tabs.

"There's so much more capacity for growth in these markets," claims Peter Kohli, who manages emerging market investments for DMS Funds in Leesport, Pennsylvania.

He says emerging markets are thriving despite the fact that the end is near for the Fed's stimulus program. "Now emerging markets are beginning to stand on their own, and I think it's a great sign."

But not all emerging markets are created equal. While Russia and Ukraine struggle, India is on a tear. The Mumbai Sensex (SENSEX) has risen almost 30% in 2014 as investors bet that new prime minister Narendra Modi can boost with the economy with market-minded reforms. Indonesia and Thailand are also bright spots.

Related: Indian economy gets a jolt

According to Kohli, the countries that have done well recently are those that have taken the political steps to become more integrated on the world stage.

"The choice is be part of the global economy and not only survive but thrive, or become more insular and suffer," he says.

That's in contrast to a nation like Russia, which has seen its currency and stock market plunge this year over its tension with the West over Ukraine.

Kohli, for his part, is down on China and Brazil, the big players in the emerging markets equation. Recent data from Brazil indicated that its economy slipped into recession in the second quarter, a period when the country was supposed to get a boon from an influx of visitors and investment for the World Cup. And concerns about China's frothy property market and shadow banking sector have weighed on investors for some time.

"Brazil had all the wrong things, and its economy has suffered," Kohli said. "I'm not a fan of China because they have an incredible real estate bubble that's going to explode."

But Michael Shaoul, CEO of Marketfield Asset Management, which manages $20 billion, thinks that investors are done selling in countries like Brazil and China. He considers the emerging markets rout earlier this year akin to a knee jerk reaction.

While he admits these countries have had a bad bout of economic data, he believes much of what's actually happening in their economies is misunderstood.

"It's a mismatch between corporate activity and economic data. The Chinese property market is a bad thing, but it doesn't have much to do with what's happening in the Shanghai equities market," he asserts, referring to China's main stock index.

"I don't deny that the data's bad; I just deny that it's directly relevant," he says.

Another factor in the emerging markets is new stimulus from the European Central Bank designed at propping up a stagnating Europe. While the ECB's easy money policies won't have as great of an impact on emerging markets as the Fed's bond buying program, it may have tangential effects. European companies, for example, should have more financial firepower to import goods from abroad.

Of course, the risks of investing in emerging markets are still real. Any major slowdown from a key player like China could spread to other emerging markets and derail the rally. And with interest rates persistently low, a sudden spike in rates could send traders scrambling for the exits.

Related: 4 risks for emerging markets

Regardless, Shaoul thinks the cloud hanging over emerging markets for the past several years is finally dissipating for real this time.

"I think emerging markets have been in the penalty box long enough," he said. "This is potentially still an exciting time to be investing there."