Debt-fearing Millennials are saying no to credit cards.

More than six out of ten Millennials, or 63%, don't have a single credit card, according to a Bankrate survey of 1,161 respondents. That compares to a mere 35% of Americans who are over the age of 30.

A tanking economy and mounting student loan debt have scared many Millennials away from opening credit cards, says Jeanine Skowronski, an analyst at Bankrate.com. The CARD Act of 2009, legislation introduced to protect consumers from high interest and fees, also made it more difficult for younger Americans to get credit cards.

Related: America's favorite credit card company is...

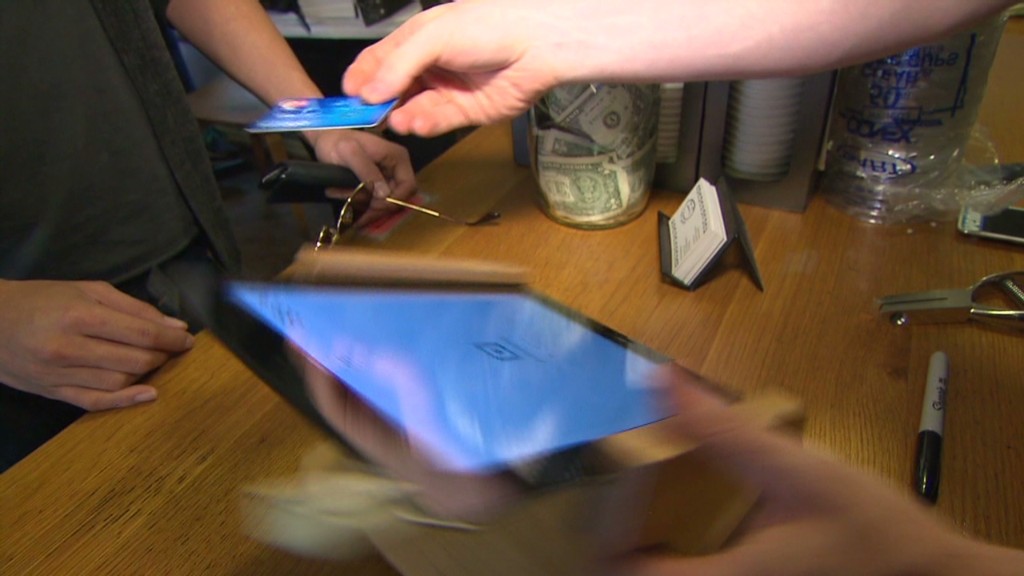

Instead, Millennials are turning to debit cards -- especially prepaid debit cards, which are reloadable and often linked to bank accounts.

This credit card exodus is part of an ongoing trend. Last year, a report from credit scoring firm FICO found that the number of young Americans without credit cards had doubled between 2007 and 2012.

But while it may seem like the responsible thing to do, forgoing credit cards means losing out on a chance to build a credit profile and boost your credit score.

Related: Millennials love cash

"The responsible use of credit cards is one of the easiest ways to build a strong credit score, which is essential for qualifying for insurance policies, auto and mortgage loans, and sometimes even a job," Skowronski says.

The key word there is "responsible," however. It's better for your credit to have no credit cards at all than to get one without knowing how to use it.

In fact, less than half, or 40%, of those Millennials with credit cards actually pay their balance in full each month, versus 53% of people 30 and older. This is likely because they are using the credit card as a way to pay for things they couldn't otherwise afford, when they should be using it as a credit building tool, says Skowronski.

"It's a mindset switch," she says. "Millennials need to approach a credit card as a way to make payments and pay off balances rather than a debt instrument."