Investors are pledging allegiance to the dollar.

The U.S. Dollar Index, which measures the value of the greenback against a basket of foreign currencies, has climbed to its highest level in over four years.

"The momentum of the dollar's advance is unprecedented," said analysts at Société Générale in a note Monday morning.

The dollar has long been the world's top business currency and viewed as a "safe bet" among investors. But the recent run up is partly because traders believe the American economy is improving, especially relative to other parts of the world. This will compel the Federal Reserve to raise interest rates, which is generally seen as a good thing for a country's currency.

At the same time, things aren't looking too good in Europe, so the European Central Bank is starting to do some stimulating of its own. Those measures have resulted in a weaker Euro. The Japanese Yen has also struggled because of the country's ongoing economic problems.

Related: Ruble's headlong plunge shows Russia hurting

The dollar trend is likely to continue, economists from Capital Economics claim. They expect the dollar "to appreciate further as the monetary policy of the Fed diverges from that of central banks elsewhere."

They predict that one euro will be worth $1.15 by the end of 2016, compared with around $1.27 now. The dollar has already gained more than 8% against the Euro in the past six months.

So what does a stronger dollar mean for the average American? That depends. Here's what to watch for:

Feeling buff: Americans can take comfort in the fact that a strong dollar is a sign of confidence in the U.S. economy. It means foreign investors are figuring that the country is a good place to park some money for the foreseeable future.

Related: Mohamed El-Erian says take some money out of stocks

A vigorous currency also makes it cheaper for companies to import goods from abroad. In other words, consumers stand to benefit from lower prices. That phenomenon could also help keep inflation in check and allow the Fed to hold interest rates down as long as necessary to keep stimulating the economy.

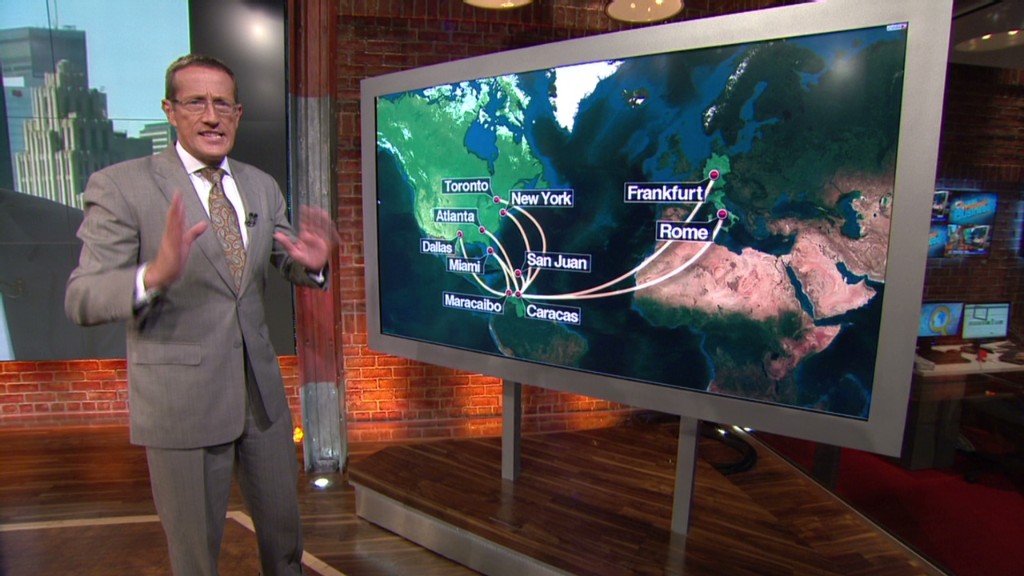

And if you're planning a vacation abroad, be sure to do a little shopping, since a favorable exchange rate should give you a little more bang for your buck. If you're eying those Italian leather shoes, now is a good time to buy them.

The downside: While a robust dollar cheapens imports, it makes American exports and products look more expensive to the rest of the world. That can hurt domestic manufacturing as U.S. firms end up competing for consumers with international rivals who are offering discounted products.

Furthermore, American-based multinationals that sell a large amount of their goods overseas get shafted when they have to exchange revenues earned abroad back into dollars.

The takeaway: While the pros and cons of a stronger dollar are very real, it's probably too early to tell the extent to which it will affect consumers and businesses. Investor sentiment can shift quickly, and any data or central bank actions that change the way investors view the global economy can reverberate quickly across the often opaque foreign exchange market.

So unless you trade currencies for a major investment firm or in your online brokerage account, you probably won't notice a huge difference just yet, except when you buy cheaper souvenirs abroad.