If you're falling behind on your debts, beware: You don't want to end up one of the millions of Americans who get their pay garnished.

To avoid being hit, call your creditor or the firm collecting the debt and try to negotiate a payment plan, said Robert Hobbs, senior fellow at the National Consumer Law Center.

Explain the details of your financial situation and propose an amount that you can realistically pay each month.

If that doesn't work and the creditor decides it wants to seize your wages, it generally needs to get a court order first. That means you have the right to appeal.

Related: Stop garnishing my paycheck!

Look at the judgment and make sure everything is correct.

For example, if you moved residences and the judgment was served at your former residence, that could be grounds for stopping the garnishment.

If you see anything incorrect, consult a lawyer. The National Association of Consumer Advocates, which publishes a directory of attorneys specializing in garnishments, is a good place to start.

If the judgment is correct, it may be a good idea to pay off the debt using a low interest loan. Taking a loan with a 5% interest rate to pay down credit card debt with a 36% interest rate could make a lot of sense, Hobbs noted.

Related: Retirees' Social Security checks garnished for student loans

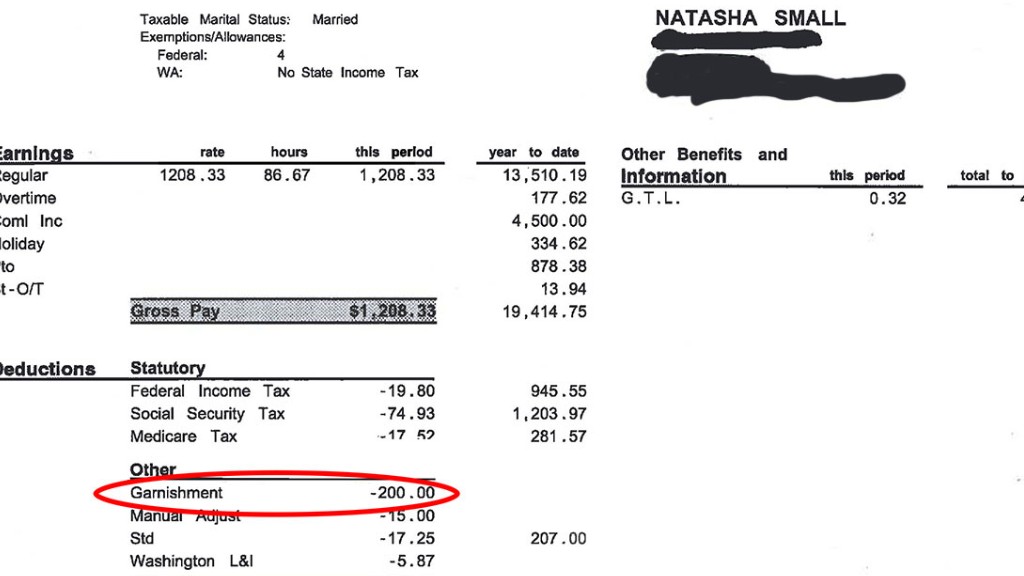

And be sure that you're not being garnished more than is allowed.

Under federal law, creditors can garnish a maximum of 25% of earnings or the amount of disposable income that exceeds 30 times the minimum wage -- whichever is smaller. Read more about your rights on the federal level here.

Some states also have rules that provide stricter limits, so check with your state department of labor. Benefits like Social Security and welfare are generally exempt from garnishment as well.

If all else fails, the last resort could be to file for bankruptcy. You can't discharge some kinds of debt in bankruptcy, like certain government debts. But you can probably get the wage withholding stopped.

The National Association of Consumer Bankruptcy Attorneys has a directory of lawyers.

"The most common reason people go bankrupt is because of a garnishment," said Hobbs. "It's not something to be done lightly, but it can get rid of most judgments."