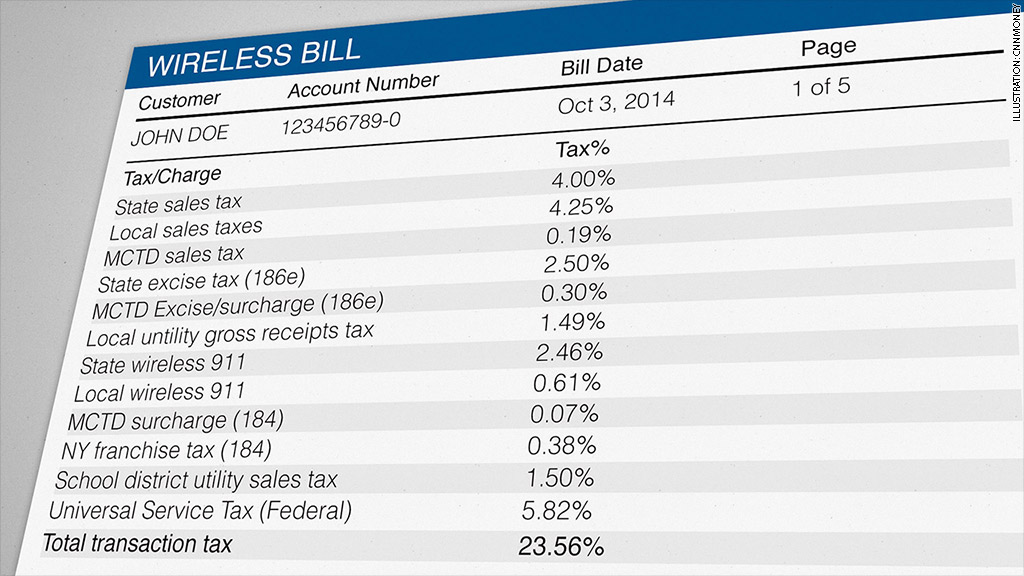

Ever try make sense of your cell phone bill? Good luck with that.

Not only will you see 9-1-1 fees, you'll also find franchise taxes, utility sales taxes and mysteriously named surcharges like the MCTD, TRS or PUC.

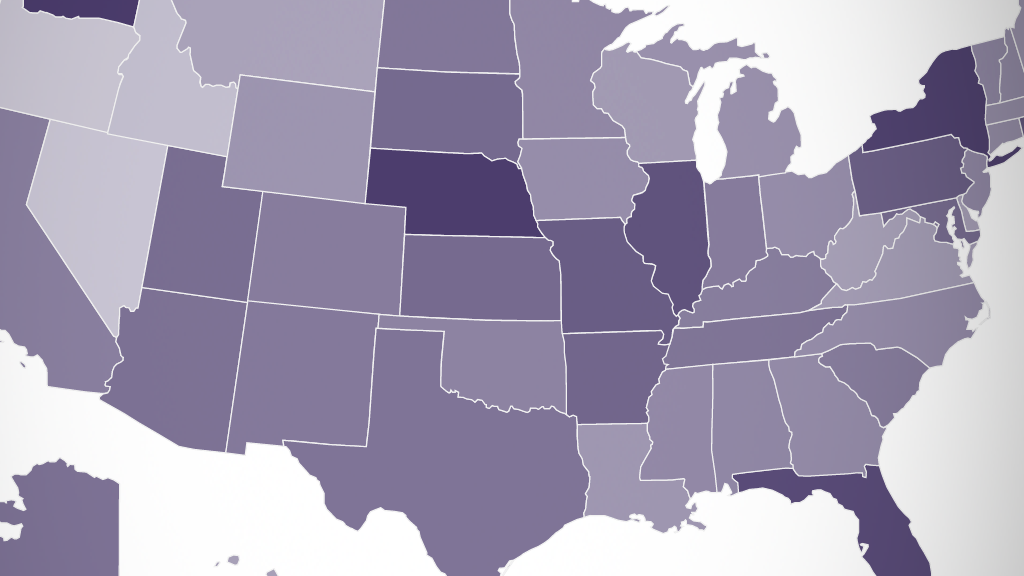

On average, customers pay 17.1% of their bill in federal, state and local taxes and fees. But in some states, the average charges can run as high as 24% of the bill, according to a new report from the Tax Foundation.

Some city residents, meanwhile, end up paying even more: Up to 35%, thanks to per-line fees and other charges.

All in, wireless customers end up paying tax and fee rates that are about twice as much as the average sales tax rate on other goods and services, the Tax Foundation found.

Here's how it breaks down: First, there's the 5.82% federal charge, which is part excise tax and part Universal Service Fund charge.

After that, how much more you pay depends on where you live.

The highest combined state and local rates are found in Washington state (18.6%), Nebraska (18.5%), New York (17.7%), Florida (16.6%) and Illinois (15.8%).

Related: The 5 best -- and worst -- airports for cell phone service

Once you tack on the federal government's levy, taxes and fees make up 22% to 24% of your bill in these states, according to the Tax Foundation.

The menu of charges won't be identical across states, either. In Nebraska, for instance you'll be charged a "city business and occupation tax," while in Illinois you'll have to pay a "simplified municipal tax." The District of Columbia, meanwhile, slaps on a 10% "Telecommunications Privilege Tax."

By contrast, states with the lowest tax rates on cellphone usage are Oregon (1.8%), Nevada (1.9%), Idaho (2.6%), Montana (6%) and West Virginia (6.2%). Their combined federal, state and local rates range from about 8% to 12%.

City dwellers tend to get hit the hardest: In a few cities - for example, Chicago, New York City and Omaha, Neb. - you may have to shell out quite a bit more.

Chicago takes the cake. If you have a family plan with four cell phone lines, you could pay 35.4% of your total bill in taxes, fees and charges. That's thanks to a recently increased 9-1-1 fee, which is now $3.90 per month, and a high per line fee of $4.

The city's 9-1-1 fee was doubled to $2.50 in 2008 to help with security upgrades as Chicago bid to host the Olympics, according to the report. The bid failed, but the fee remained at $2.50. The rationale for the most recent hike was to avoid a property tax increase. In both cases, the hikes were unrelated to direct spending on the 9-1-1 system.

Related: IRS eyes tax on Silicon Valley's free lunches

"Facing continual revenue challenges, some states and cities have resorted to targeting wireless customers as a source for additional revenue," the Tax Foundation report noted.

And it may not be the fairest way to raise cash.

Given how essential cell phones have become - from keeping tabs on your young kids to being reachable for work - high taxes and fees can be especially hard on poorer citizens, the report's authors contend. "Excessive taxes and fees may reduce low-income consumers' access to wireless service at a time when such access is critical to economic success."