When it comes to putting money away for retirement, women outmatch men:

They are more diligent savers and more likely to put a bigger percentage of their paycheck into a savings plan.

But when it comes to the final savings tally, women are falling far behind.

According to a Vanguard analysis of more than 1 million 401(k) savers, women are 10% more likely to enroll in their workplace savings plan and save a bigger chunk of their paychecks.

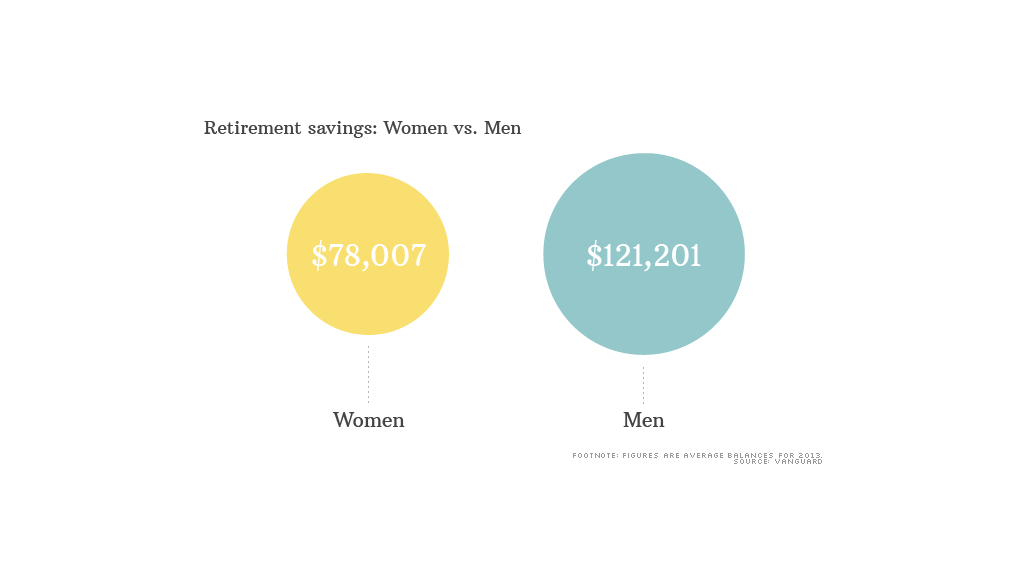

Yet Vanguard's analysis found that female savers have an average balance of $78,000 -- far below the male average balance of $121,000.

What gives?

You can blame some of it on the wage gap, says Jean Young, a Vanguard senior research analyst.

Overall, men in the survey earned an average of 40% more than women.

When Vanguard compared men and women of comparable incomes, women tended to have similar average savings to their male counterparts in most income brackets.

But a big disparity appeared among the highest earners, where there were far more male workers bringing in much higher income, explained Young.

"Put simply, wages help determine how much people save," she wrote recently.

But there are other factors at play as well. On average, women work 12 years less than men do over the course of their careers, according to the AARP Public Policy Institute.

A major reason: Women are more likely to take time off work to raise kids or to care for a sick spouse or aging parents.

In addition, Young cautioned that 401(k) balances only provide part of a worker's overall retirement picture since savers often have multiple retirement accounts and may have a spouse's savings as well.