You don't have to be a member of the 1% to invest in the stock market -- or make money from it.

That's the message Angie Ellerbroek is instilling in her three children. They are all under 12-years-old, but they already own stock.

"We're middle class of the middle class," Angie, who lives in the Midwest, told CNNMoney. "We live within our means. We don't buy new vehicles."

Angie and her husband were frustrated that their childrens' saving accounts were making a mere 0.17% a year in the bank. In other words, nothing.

They had worked hard to save up a bit of money for their kids -- about $1,500 for each child. In the fall of 2011, Angie had an epiphany: It was time to put the savings in the stock market.

"I explained everything to the kids before investing their savings, and they were on board," she said.

Related: Who's getting rich off the stock market?

Each child started by putting money into one stock -- something they had a connection to.

"I bought Apple (AAPL) for my son because he loves computers. I bought Disney (DIS) for one daughter because she loves Disney movies. And for my youngest I bought Honeywell (HON)because she was sick and taking spoons of honey for her cough, and we have a Honeywell thermometer," she explained.

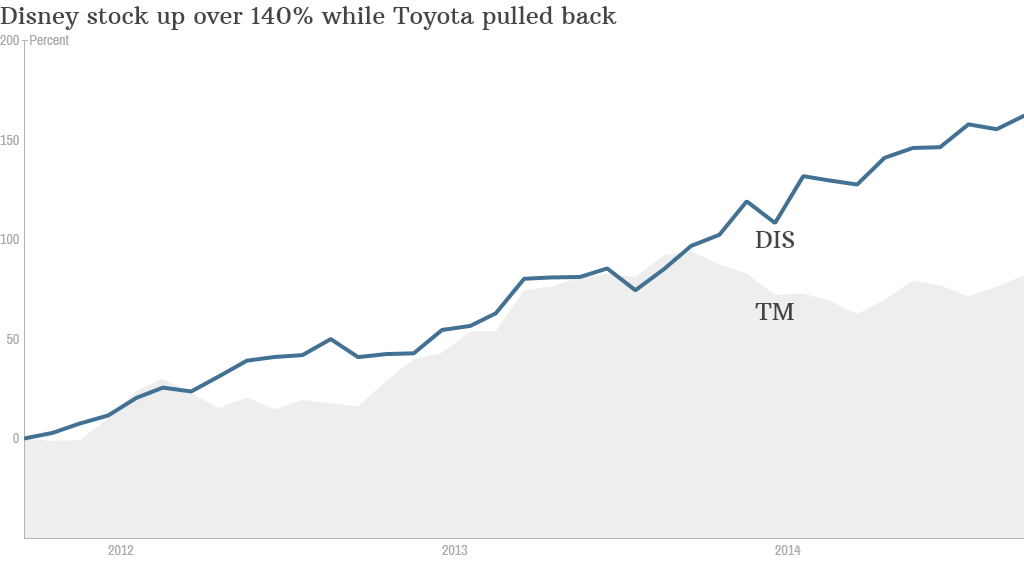

Angie also got into the action, purchasing shares of Toyota (TM) since she believed it was a strong brand in 2011 and the recall crisis seemed to be behind it.

Related: Is Apple the perfect stock?

Investing is now dinner table conversation -- and a fun game as the entire family follows the market. While the Ellerbroeks have a friendly competition going to see who has gained the most each week, the reality is everyone is doing very well -- certainly better than they would have if they kept their money in the bank.

The daughter invested in Disney has the most bragging rights. She is up over 140%. The son in Apple is up 85% and even got to experience a stock split earlier this year. The youngest daughter is up close to 70% -- roughly on par with the S&P 500 return since her initial investment.

Bringing up the rear is mom, although Angie isn't complaining about her 67% return either.

"Regardless of our unrealized gains, it's been a good lesson for the kids to watch their investments," Angie said.

The family has since diversified the investment portfolios somewhat, although they don't see the kids' funds as particularly risky since the plan is to keep the money in the market for a long time.

Angie knows the benefits only too well. An aunt who worked hard for UPS (UPS) and didn't have any children of her own would occasionally gift her nieces and nephews stocks. Angie received her first one when she around age 10 or 12.

"When I grew up and used it, I had about $80,000 that had accrued and split so many times. That helped us buy our first house," Angie said.

It was a better lesson about money -- and the power of investing over time -- than any she has learned in the classroom. Now her kids are learning too.