Investors are seeing a serious amount of red this morning.

Here are the five things you need to know before the opening bell rings in New York:

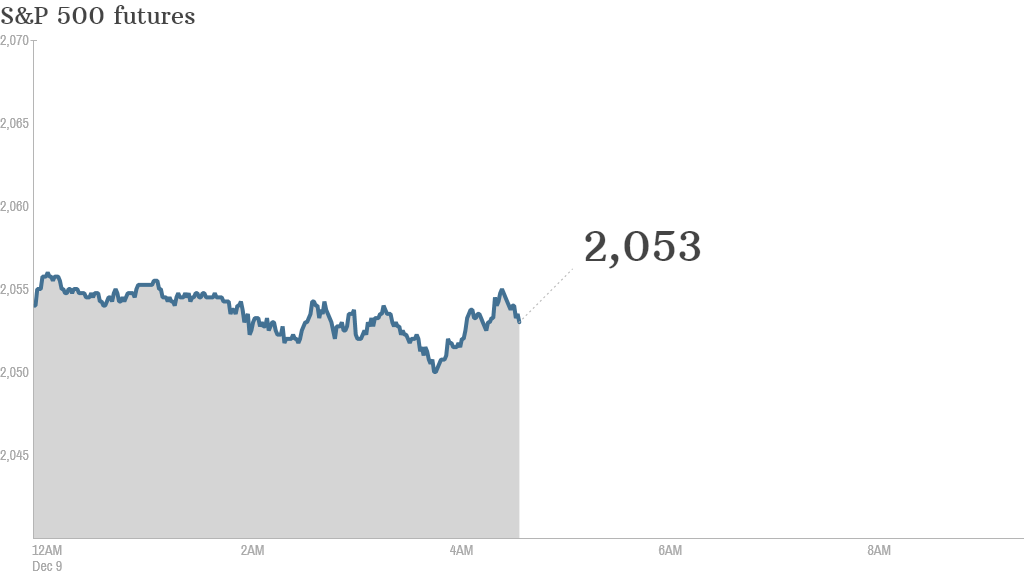

1. Stock markets tumbling: Every single major global stock market is trading in the red -- or closed with losses Tuesday -- and U.S. stock futures are looking pretty weak.

Traders are blaming oil for the widespread loss of confidence in stock markets. Crude oil is trading below $64 per barrel, a level not seen since 2009, and that is seriously hurting oil companies and igniting concerns about a squeeze on the booming American oil industry.

"Investors are worried that there is no floor in sight for crushing oil prices," said Naeem Aslam, chief market analyst at AvaTrade.

Across Europe, most indexes are declining by more than 1%. The losses were even more dramatic in Asia, where the Shanghai Composite index plunged more than 5%.

Related: Chinese stocks have been on an incredible mystery run

2. Tesco troubles: In the U.K., shares in the grocery giant Tesco (TSCDY) tumbled about 11% after the company issued another profit warning. The grocer has been struggling amid increased competition and an accounting scandal in which it admitted to overstating its profit forecasts. Even the stalwart shareholder Warren Buffett has been cutting back on his investment in the company.

3. Monday market recap: U.S. indexes lost ground in the previous session. The Dow Jones industrial average lost 0.6%, while the S&P 500 slid 0.7% and the Nasdaq closed down 0.8%.

4. Russian ruble sinking: The Russian ruble continued declining Tuesday and is trading near all-time lows. The currency has fallen by about 40% against the U.S. dollar this year.

The Russian economy has been hit from all sides this year as it struggles with Western sanctions, declining oil prices and high inflation.

Experts are increasingly worried Russian authorities may introduce capital controls -- which limit the flow of money -- in an effort to manage the economy. However, a move of this kind can further erode confidence in the financial system and spur consumer panic.

5. Earnings update: AutoZone (AZO) and Burlington Stores (BURL) will report quarterly earnings before the opening bell. Krispy Kreme (KKD) will report after the close.