Get ready for a Monday bounce.

Here are the four things you need to know before the opening bell rings in New York:

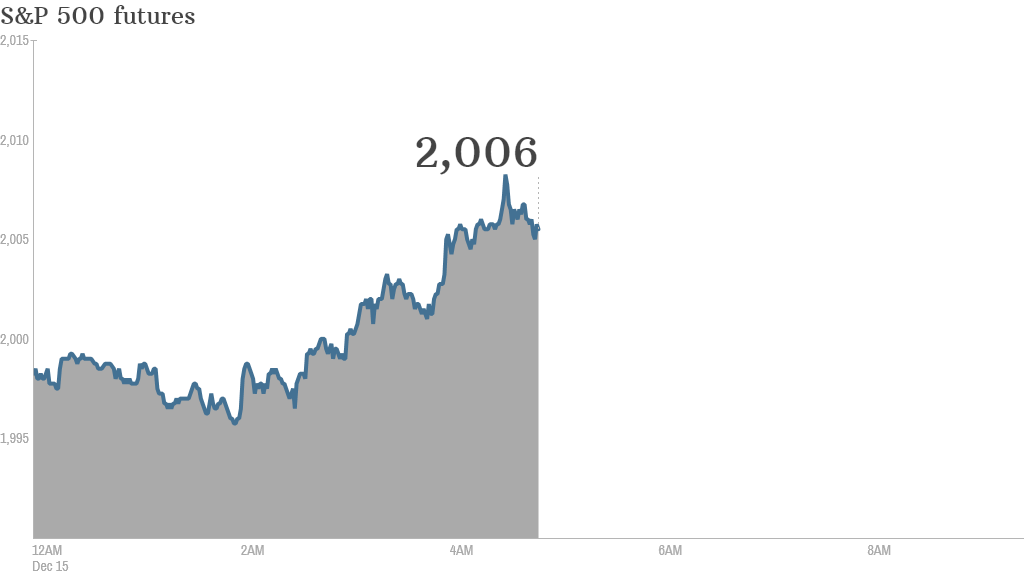

1. A bounce after big losses: U.S. stock futures are all moving up, setting the stage for a rebound after both the Dow Jones industrial average and S&P 500 each dropped by about 3.5% last week.

European markets were also pushing higher in morning trading.

Concerns about the impact of plunging oil prices have contributed to recent market volatility. Crude futures were edging up Monday, and shares in big oil companies look set to rally, despite weekend reports that OPEC won't rush to cut oil production even if prices fall as low as $40 per barrel.

2. Bringing Abe back: Japanese voters backed Prime Minister Shinzo Abe in a snap election Sunday.

The win gives Abe four more years to institute his policies aimed at reviving Japan's economy by flooding the market with cash, encouraging corporations to create more jobs and increasing government spending.

Japan unexpectedly slipped into a recession this year, dealing a blow to Abe's much-vaunted Abenomics economic revival strategy.

Tokyo's Nikkei index declined by 1.6% Monday.

3. Australian hostage situation hits markets: The main Australian index was down by 0.6% Monday as markets reacted to a hostage situation at a cafe in Sydney.

Shares in Qantas Airways (QUBSF) dropped by 5.4% as investors predict the hostage standoff could hurt tourism and air travel.

4. Stock market mover -- Petsmart: Shares in Petsmart (PETM) are rising by about 6% premarket after the retailer agreed to be acquired for $8.7 billion in the largest private equity deal so far this year.

A group of investors led by BC Partners will pay $83 a share, a 39% premium to Petsmart's stock price before it began exploring a possible sale in early July.