Fear is back in the markets and oil is falling again.

Here are the five things you need to know before the opening bell rings in New York:

1. Fear is here: The CNNMoney Fear & Greed index shows markets are extremely fearful as oil prices fall off a cliff and Russia struggles to deal with a full-blown currency crisis. Until recently, the index had been stuck in neutral for weeks.

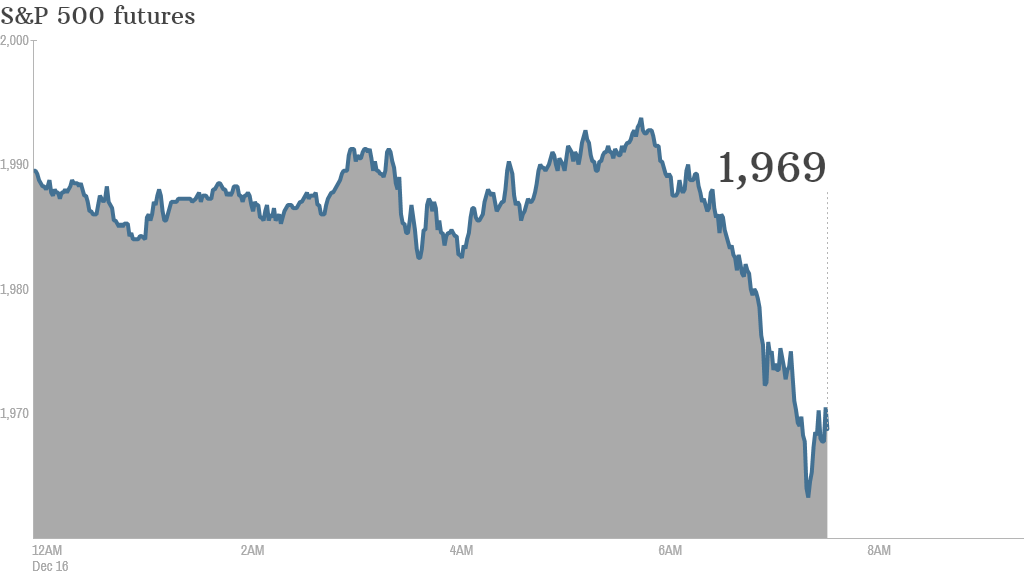

U.S. stock futures were moving lower, setting the stage for a third consecutive day of declines. European markets were all dropping in afternoon trading. Nearly all Asian markets closed with losses.

U.S. stocks fell Monday. The Dow lost 100 points, the S&P 500 fell 0.6%, and the Nasdaq closed 1% lower.

2. Oil keeps falling: Crude prices in the U.S. are continuing to fall, with oil futures declining by about 3% overnight to trade near $54 per barrel.

The latest dip is being blamed on China, where new data from HSBC shows sentiment among key managers in the manufacturing sector dipped to a seven-month low in December. This data raises red flags about economic growth and demand for oil in the world's biggest importer.

The unexpectedly sharp fall in prices this year -- down by more than 45% since June -- is wreaking havoc on many oil-producing nations and creating unexpected knock-on effects around the world.

Related: As oil falls, Middle East stocks tank

3. Panic in Russia: The Russian currency continues to fall sharply Tuesday despite a shock overnight rise in interest rates to 17% from 10.5%. The ruble is off by about 13% for the day and has fallen by roughly 57% versus the U.S. dollar since the start of the year.

Russia, which relies heavily on its energy sector, is getting hurt by falling oil prices and tit-for-tat sanctions with various Western nations.

"The unease in Russia was a factor in causing nervous trade in many markets on Monday," said Simon Smith, a chief economist at FxPro in London.

Related: Russia's ruble rout rattles emerging markets

4. Earnings and economics: Darden Restaurants (DRI), the owner of chains like the Olive Garden and LongHorn Steakhouse, will report earnings after the closing bell.

The U.S. government will release monthly data on housing starts and building permits at 8:30 a.m. ET.