Markets are watching the Federal Reserve closely Wednesday, though concerns about oil prices and Russia haven't gone away.

Here are the five things you need to know before the opening bell rings in New York:

1. Fed focus: Investors will be monitoring the Federal Reserve news conference at 2 p.m. ET to gauge what Fed chair Janet Yellen is planning for monetary policy over the coming year.

The Fed previously reassured markets that any rate rise would be a "considerable time" away, but analysts say the language may be tweaked, despite the deflationary impact of plunging oil prices. The Fed has held its key short-term rate near zero since 2008.

"Recent commentary from Fed officials have floated the idea of a rate rise around the middle of next year," said Tom Beevers, CEO of StockViews. "[The] removal of the "considerable time" language would certainly reinforce this expectation."

Crude oil futures are weaker again on Wednesday, trading around $55 per barrel.

Related: Oil is freaking out the stock market

2. Earnings and market movers: FedEx (FDX) and General Mills (GIS) will post quarterly earnings before the opening bell. Oracle (ORCL) will report after the close.

Shares in American Apparel (APP) are expected to surge at the open after the company announced that it was finally replacing controversial CEO Dov Charney, six months after he was fired. The stock has fallen by more than 50% this year.

Shares of Darden Restaurants (DRI) popped by about 2% in extended trading on earnings that narrowly beat expectations.

Sony (SNE) shares are worth watching after a New York cinema canceled the premiere of its controversial film, "The Interview." A group that claimed it hacked Sony Pictures threatened people who go to watch the movie with a "bitter fate."

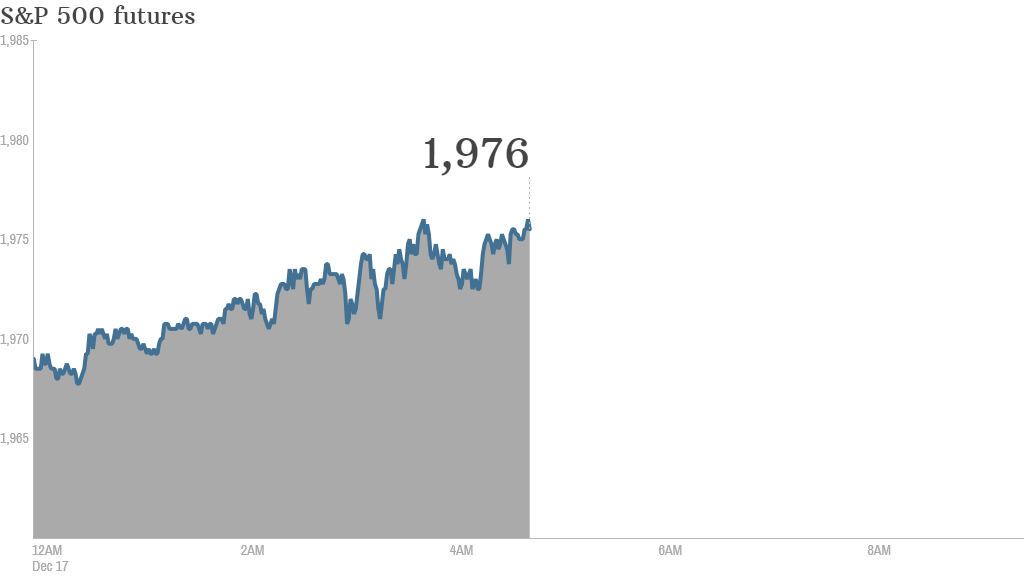

3. Ready for a rebound?: U.S. stock futures are rising Wednesday, though the markets have been fickle lately, and CNNMoney's Fear & Greed index still shows investors are feeling fearful.

All the major U.S. indexes have declined for three consecutive trading days. The Dow lost 112 points on Tuesday, the S&P 500 slid 0.9%, and the Nasdaq fell 1.2% lower.

4. Ruble steadying: The Russian ruble, which has plunged by over 50% since the start of the year, is rising by about 2% versus the U.S. dollar Wednesday.

The currency is stabilizing after enduring two consecutive days of heavy losses. Russian authorities are reportedly selling foreign exchange reserves.

Related: Putin's cronies lose $50 billion

5. International markets overview: All major European markets were declining in early trading.

Greece is voting for a new president Wednesday and Russian concerns are still top of mind, which has created a negative mood in Europe. Asian markets closed with mixed results.