Gold bugs rejoice! For now, at least.

With stocks, oil and the euro all plunging since the year began, the yellow metal is off to a hot start in the first few days of 2015.

Although gold pulled back a bit Wednesday as the broader market rallied, prices are still up about 2.5% so far. Ditto for the popular SPDR Gold Shares ETF (GLD). And Newmont Mining (NEM) has surged 5%, making it one of the top performing stocks in the S&P 500 so far in 2015.

Why is gold glittering? And can it last?

The gold rally is likely due to renewed fears about Europe, particularly what might happen if the Syriza party wins Greek elections on January 25.

Related: Get ready for a new Greek drama

There is speculation that a Syriza victory could lead to Greece leaving the eurozone. The term "Grexit" has once again entered the market's vernacular.

Gold often does well in times of political turmoil. Prices spiked to a record (not adjusted for inflation) of above $1,900 an ounce the last time there were serious concerns about Greece and Europe back in 2011.

But gold has been a dog of an investment since then. Even after its recent spike, it is still trading for only around $1,210 an ounce ... nearly 60% below its all-time peak.

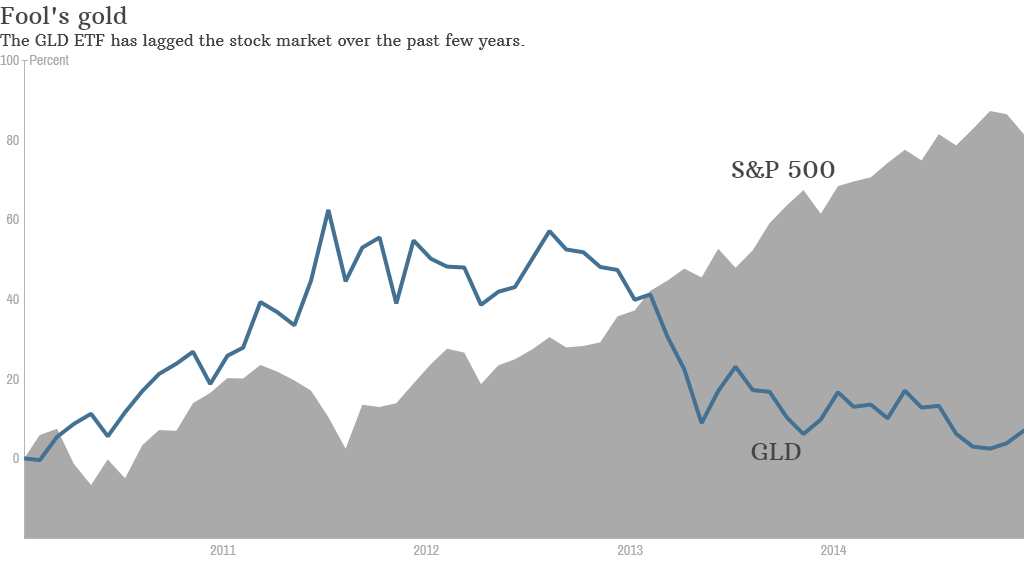

Gold had a similar mini-spike last year when investors were worried about the health of the so-called Fragile Five emerging markets. The GLD ETF surged 10% in the first 2 months of 2014 but wound up finishing the year down 4% ... its second consecutive annual loss.

If you had been betting more on gold than stocks over the past few years, you would not be very happy.

Gold at Goldilocks price? Jason Pride, director of investment strategy with asset management firm Glenmede, said that investors should not be chasing gold right now. He thinks that a fair value for the metal is between $1,000 and $1,200 an ounce.

"There is no compelling reason that gold looks attractive. The fact that it's rising is more due to the latest situation with Greece. Gold often rises the most when there are government stresses."

That may be true. Safe havens are definitely back in vogue on Wall Street right now. Investors are rushing into U.S. Treasury bonds. And CNNMoney's Fear & Greed Index is showing signs of Extreme Fear. But this heightened sense of anxiety could prove to be temporary.

Related: Stocks should fall further. Here's why.

Then again, you could also make the case that this Greek crisis may be more serious than 2011. An exit from the eurozone has been long discussed but nobody knows what would happen if Greece actually dropped the euro currency. That's the proverbial case of uncharted territory.

It's also important to note that the European Central Bank is widely expected to eventually launch a round of asset purchases similar to the quantitative easing programs that the Federal Reserve and Bank of Japan had used. If that happens, the euro could weaken further.

Europe is already in deflation territory, with consumer prices sinking last month for the first time since September 2009.

Related: Keep track of gold, oil and other commodity prices

Gold as currency hedge: And while gold is often viewed by analysts as a hedge against inflation -- which is practically nonexistent in the U.S. as well as Europe -- experts say gold can also do well during times when people are worried about falling prices, especially drops in the value of national currencies.

The allure of gold to its fans is that it is a tangible asset. The value is determined, for the most part, by supply and demand. And supply is fixed, It's basically what you can find in the ground and is available on the open market. The supply of dollars, euros, yen and other paper currencies can be increased or decreased by the central banks of governments. They simply turn on or shut off the printing presses.

"Global money printing — first by the Fed, now by Japan and likely soon by Europe — is sowing the seeds of future inflation. That may be years from now, so it's not an immediate concern. But that's why we believe investors should have a small allocation to gold or other inflation-correlated assets in their portfolio," wrote analysts from USAA Investment in their 2015 market outlook.

So owning some gold -- the metal itself or stocks or ETFs tied to it -- could make sense for investors. Just don't go overboard and bet the ranch. You don't want to end up like some destitute miner after the great California Gold Rush of the mid-1800s ended.