Big energy companies aren't the only ones losing out on the dramatic fall in oil prices. Banks are in the hot seat, too.

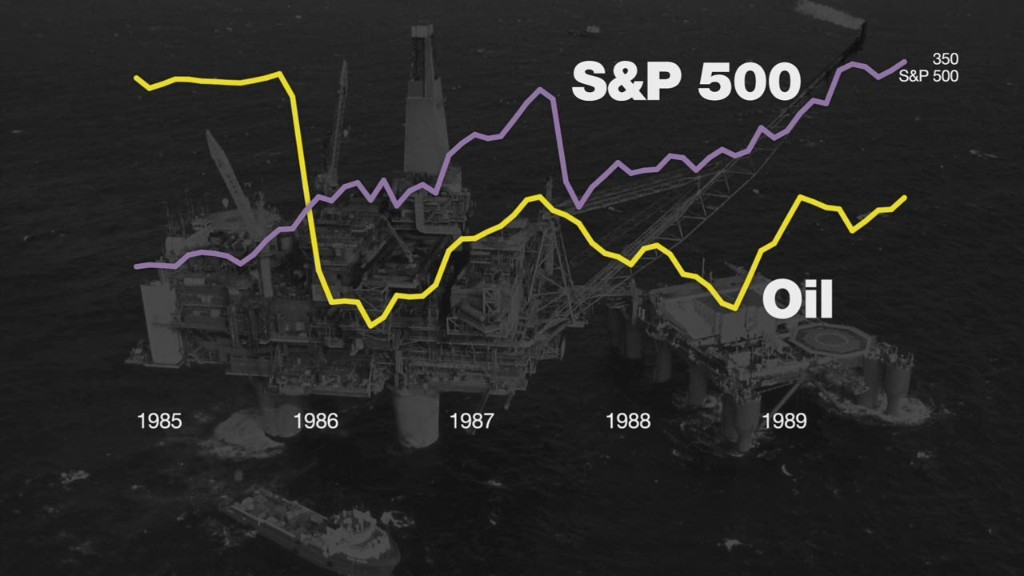

Hundreds of banks were forced to shut down in Texas when the state fell into a recession in 1986 during a steep decline in oil prices. That 1980s meltdown mirrors the current drop in prices that carried oil below $45 a barrel this week.

Cheap credit helped fuel the U.S. shale boom, allowing countless energy companies to find oil in new places. Banks also capitalized on economic booms in oil-rich regions like Texas and North Dakota. It would only make sense for these same banks to feel some pain from oil's downward spiral.

Drilling projects that made sense at $100 may now be losing money, creating headaches for the lenders that financed the expansions. Some highly-leveraged shale companies may even go belly up due to the plunge in oil prices.

Related: 'Been there, done that.' Texas braces for another oil bust

But there's also the economic fallout of the energy meltdown. It's great for consumers saving money on gas, but Texas is bracing for a wave of layoffs and a possible oil-fueled recession. Other big energy regions like North Dakota, Oklahoma and Alaska are also facing economic headwinds.

Bank losses likely to grow: If the oil plunge causes certain economies to stumble, banks are likely to be hit by higher credit losses and a slowdown or even decline in loan growth. Likewise, fees for wealth management and customer activity could be dented.

"If you're a small bank in Texas or North Dakota, the risk goes well beyond drilling for oil or gas. You funded the mobile homes that workers live in, the doctor's office and other facilities that live off the energy industry," said Dick Bove, a banking analyst at Rafferty Capital Markets.

"There's no question about the fact that energy is going to be a big issue for banks, particularly the ones closely associated with production areas," he said.

Related: Stay away from these oil stocks

Banks feeling the energy heat: So which banks are most at risk to the current oil plunge? Morgan Stanley says to look at the ones with a significant chunk of their deposits located around previously-hot shale regions, including the Bakken, Eagle Ford, Niobrara and Permian plays.

The U.S. banks with at least $1 billion in assets that have the greatest percentage of deposits in these regions are International Bancshares (IBOC) (42.4%), Guaranty Bancorp (GBNK) (39.7%), Cullen/Frost Bankers (CFR) (35.9%), CoBiz Financial (COBZ) (26.6%), First Interstate (FIBK) (17.3%) and National Bank Holdings (NBHC) (16.3%), according to Morgan Stanley.

Exposures for certain banks mount if the analysis includes Houston and Dallas, two metro areas that may experience oil fallout as well.

Including Houston and Dallas, Cullen/Frost's exposure soars to 78%, while Prosperity Bancshares (PB) comes in at 37% and Zions Bancorp (ZION) hits 24%, according to Morgan Stanley.

Related: Why oil could rebound to $80

Too big to feel oil tumble? Even Wall Street banks are facing questions about the impact of falling oil prices.

While just a small fraction of their total loan portfolio is directly tied to energy lending, Bove estimates around 20% of their investment banking revenue comes from energy.

JPMorgan Chase (JPM) CEO Jamie Dimon, in a call with analysts this week, acknowledged there may be "slight negatives" for the bank related to commercial and real estate trouble in Dallas, Denver and Houston.

Yet the big banks are well diversified. That means they should benefit from the anticipated boost to consumer spending caused by lower oil prices.

The oil price slide is "not going to be a big deal" for JPMorgan, Dimon said.