Markets are looking calm Wednesday, but there's plenty happening.

Here are the 6 things you need to know before the opening bell rings in New York:

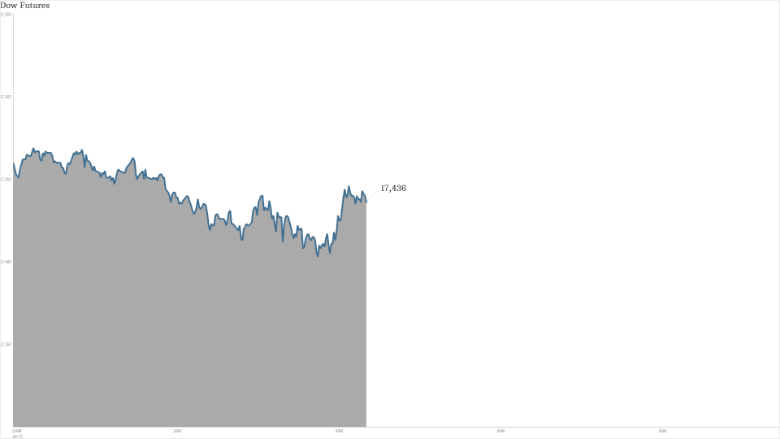

1. Futures dip: U.S. stock futures were inching lower, pointing to a lackluster start to the session. Dow Futures were down 0.2%. Telecommunications equipment maker Qualcomm (QCOM)was the sharpest decliner, with shares down nearly 5%.

2. ECB countdown: The European Central Bank is widely expected to unveil plans for massive bond purchases when it meets on Thursday. A Fed-style quantitative easing program is the last big weapon in the central bank's arsenal to boost the region's ailing economy and revitalize financial markets.

3. Gold rallies: Anticipation of a move by the ECB is driving up gold prices. The precious metal is trading above $1,300 an ounce -- its highest level 5 months. Gold benefits from bets from money printing as the commodity is seen as a safe store of value and a hedge against inflation.

4. Earnings & economics: American Express (AXP) and eBay (EBAY) will post earnings after the closing bell. On the economic front, the U.S. Census Bureau reports monthly housing starts and building permits at 8:30 a.m. ET.

5. International markets: European markets were mostly lower in early trading, though London's FTSE index edged up. Most Asian markets ended with solid gains -- including a 4.7% jump for the Shanghai Composite -- but Japan's Nikkei index closed down 0.5%.

6. Market recap: U.S. markets notched slim gains Tuesday, with the S&P 500 up 0.2% and the Nasdaq adding 0.4%. The Dow Jones industrial average was steady.

Netflix (NFLX) shares soared in after-hours trading as investors cheered better-than-expected earnings, strong subscriber growth, and plans for new original content.

But in the latest reminder that cheap oil isn't good for everyone, Baker Hughes (BHI) shares sank in extended trading after the energy company said it was slashing 7,000 jobs and cutting spending by 20%.