Owning a home is key to unlocking the American dream, but it's much harder to achieve if you're black or Hispanic.

That's according to a new study of mortgage approval rates by the online real estate website Zillow.

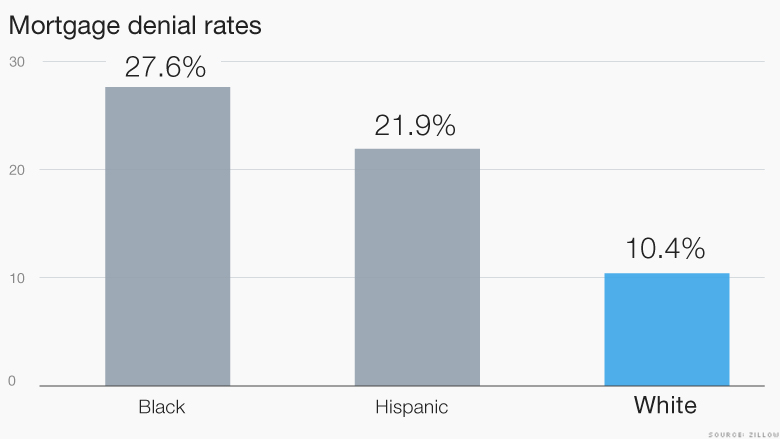

The study found that white people who apply for a conventional mortgage are denied just over 10% of the time.

By contrast, blacks who apply for the same loans are denied nearly 28% of the time, while Hispanics are denied 22% of the time.

Zillow's analysis was based on 2013 data from the federal government, which annually collects information from mortgage lenders to identify possible discriminatory lending practices and to ensure that housing needs of all communities are being met.

"Home ownership, being a path to wealth and vehicle for savings, is a very important part of Americans' lives," said Skylar Olsen, senior economist at Zillow. "When we look at home ownership patterns over time, we do see some pretty shocking differences."

The hurdles that black and Hispanic borrowers face in obtaining a mortgage means fewer people in those communities own their homes. More than 70% of white people own their home, compared with about 42% of blacks and 45% of Hispanics, according to Zillow (Z).

The difference in home ownership between black and white households is the same now as it was in 1900, based in Zillow's analysis of Census data.

Related: Where zombie foreclosures are making a comeback

Zillow said that one reason is that whites tend to make more money than blacks and Hispanics do, which makes qualifying for a loan much easier. Zillow's chief economist Stan Humphries said white applicants make roughly $20,000 more per year than comparable black and Hispanic borrowers on regular mortgages.

The disparity in mortgage approval rates narrows only a little for loans to lower income borrowers, based on mortgages backed by the Federal Housing Administration. FHA loans are popular among those with low incomes or poor credit because they have lower down payments.

The denial rates on FHA loans too are a lot higher for blacks (24.3%) and Hispanics (20.5%), than for whites (14.2%), according to the study.

Related: Old foreclosure debt coming back to haunt former homeowners

The study also found that home prices in black and Hispanic communities have yet to fully recover from the housing meltdown. In Los Angeles, home prices in black and Hispanic neighborhoods are still 20% below peak levels, while prices in the city's white enclaves have rebounded sharply.

The racial divide in home prices can be partly explained by geography.

Prices in neighborhoods with a higher concentration of blacks and Hispanics grew faster during the boom, and fell even harder when the housing bubble burst, Zillow said.

Despite the geographic and income factors, the study concludes that black and Hispanic people are at a significant disadvantage in the housing market.

"It's clear that the housing playing field remains strikingly unequal in this country," said Humphries.