Saudi Arabia is largely responsible for the dramatic fall in oil and gas prices in recent months, a U.S. government official said.

Richard Fisher, the head of the Dallas Federal Reserve, said "the Saudis have engineered" the oil crisis. He was speaking Wednesday at the Economic Club of New York.

"We are a huge supplier of energy. The Saudis took a while to realize what was going on," Fisher said, referring to the massive growth of the U.S. oil industry in recent years.

Fisher is the most prominent U.S. official to pin the blame largely on Saudi Arabia.

Related: OPEC leader: Oil could shoot back to $200

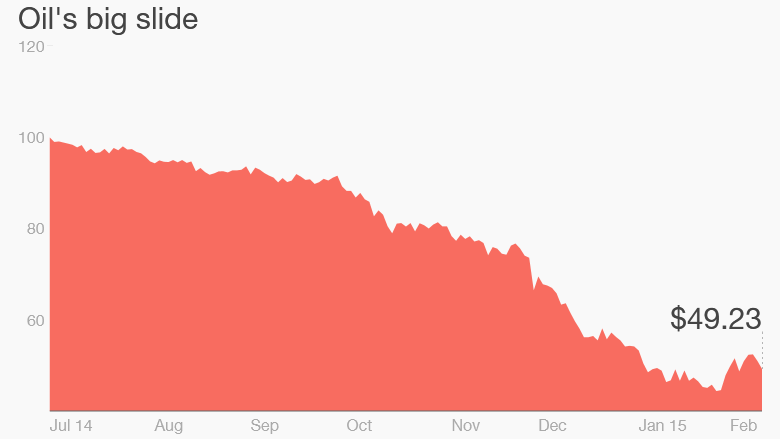

As recently as July, oil traded at over $100 a barrel. By January, it had plunged below $50.

Saudi officials have repeatedly blamed supply and demand for the price meltdown. They say they were caught off guard by the price decline, and acknowledge this is putting a lot of pressure on U.S. shale.

"Although Saudi Arabia and OPEC countries did not engineer the reduction in the price of oil, there's a positive side effect, whereby at a certain price, we will see how many shale oil production companies run out of business," Prince Alwaleed bin Talal, a member of the Saudi royal family and prominent global investor, said in January.

Related: Oil at $55 per barrel is here to stay

The oil games: While the price of oil started falling at the end of the summer, it was exacerbated on Thanksgiving Day when OPEC, led by Saudi Arabia, voted not to scale back on production. That send oil prices diving.

Fisher also noted that the Saudis benefit not just economically, but politically from the oil price decline. Low oil prices especially hurt their biggest regional rival: Iran.

"I'm sure King Abdullah thought to himself, 'I've also done a favor vis-a-vis Iran,'" Fisher told reporters. Iran's economy needs oil to trade around $135. Saudi has far larger cash reserves and is thus able to withstand a downturn in prices for much longer.

Related: These countries are getting killed by cheap oil

What's ahead for oil prices? Given how motivated Saudi Arabia is to keep prices low right now, Fisher doesn't expect oil will shoot up to $100 a barrel again any time soon.

"From a budget stand point, [the Saudis] have reserves that can handle this," he said.

While many energy companies are laying off workers and slashing spending, Fisher said that cheap oil's overall impact on the U.S. economy will be positive. A typical American driver is expected to save $750 this year at the pump, according to government estimates.

Even in his home state of Texas, Fisher said the economy has diversified a lot more beyond oil, so it's unlikely to be nearly as bad of an effect as the last oil bust of the 1980s.