The New York Times has one message for the Federal Reserve: pump the brakes.

On Saturday, the gray lady's editorial board added to the big debate on when the Fed should raise rates from their historic lows near zero, urging the bank to wait longer.

Many on Wall Street believe the Fed could act as early as June. Any rate increase will impact workers, investors and stock markets around the world.

The Fed's policy committee meets this month, and it may decide to speed up its timetable for raising rates, which it hasn't done in almost a decade. Fed Chair Janet Yellen argues that any rate increase would be a vote of confidence that the U.S. economy is improving and the Fed doesn't want it to overheat too fast.

The New York Times disagrees. Their big objection is that too many workers are still struggling and a rate increase in will only make it worse.

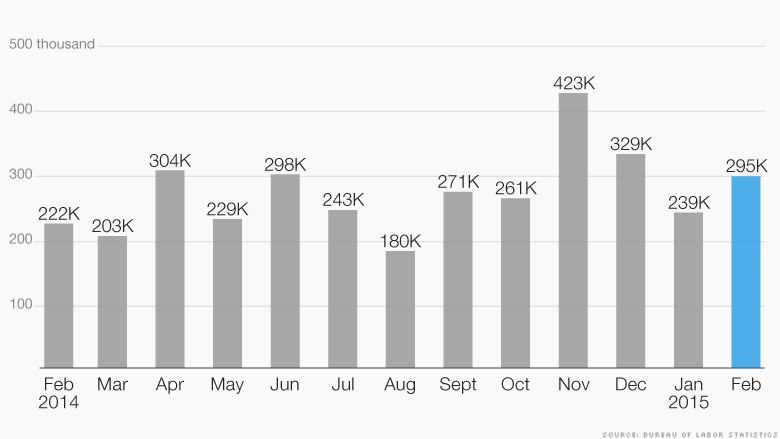

"Ignoring these signs of weakness would be foolish," the Times editorial board opined despite another strong jobs report Friday.

Related: Good news: Unemployment at lowest in 7 years

Getting people back to work: Although the national unemployment rate dropped to 5.5% last month for the first time since the financial crisis, the Times argues that the U.S. economy needs more time to get people back to work and have wages rise.

"Raising rates in the near term would lock in high unemployment among minorities and wage stagnation," the Times editorial board wrote.

The Times points out that unemployment for blacks (10.4%) and Hispanics (7.3%) is still high while wages are flat for everyone. Its argument is simple: the economy isn't healthy enough to raise rates.

But using the Times' metrics, raising rates now isn't unprecedented. When the Fed started lifting rates in 2004, unemployment for blacks was 10.2% and for Latinos 6.6% -- not terribly different. While the Fed steadily increased rates between 2004 and 2006, unemployment dropped for both groups. The same thing happened when the Fed raised rates in 1994.

Related: Americans need a raise. Is it (finally) coming?

Show me the wage growth: The editorial board also stresses that wages have "barely budged" during the six-year recovery. Wages grew by 2.2% in February, well below the Fed's target for 3.5% growth.

This is the fourth time since November that the Times editorial board has weighed in to urge the Fed to hold off on raising rates, but the discussion has shifted considerably in recent weeks as the labor market continues to improve.

Some economists and business leaders say the Fed shouldn't wait for wage growth to raise rates. Wages almost always rise a few months after hiring really picks up. The expectation is that compensation will pick up later this year, if not sooner.

"If they're waiting for clear conviction of wage growth at 3%...it'll be too late" says Sam Bullard, senior economist at Wells Fargo. Bullard sees the Fed raising rates in June.

Bullard isn't alone.

"[The Federal Reserve] knows that wage growth is around the corner, I don't think they necessarily need to wait to see that," says Frank Friedman, interim CEO at Deloitte, which audits the Fed. Friedman says wages at Deloitte have and will continue to increase this year.

The debate rages on...