Welcome to Wednesday.

Here are the five things you need to know before the opening bell rings in New York:

1. Fed in focus: All eyes are on the U.S. Federal Reserve as it ends its two-day policy meeting. The Fed is expected to leave monetary policy unchanged, but rates are widely forecast to go up this summer.

Investors are particularly interested in what chairwoman Janet Yellen will have to say at 2 p.m. ET about the timing of an interest rate rise.

"[This Fed] meeting announcement and press conference have the potential to reshape market expectations around the start and pace of Fed tightening," explained Maury Harris, an economist at UBS.

2. Politics setting the pace: The main Israeli stock market is edging up by about 0.5% after Prime Minister Benjamin Netanyahu declared victory for his Likud party following a tumultuous election. He'll now have to work on forming a coalition government with other parties.

Meanwhile, British investors are awaiting the latest U.K. budget, an annual event where the government outlines its plans for taxes and spending. Chancellor George Osborne's speech could set the tone for campaigning before the U.K. general election on May 7.

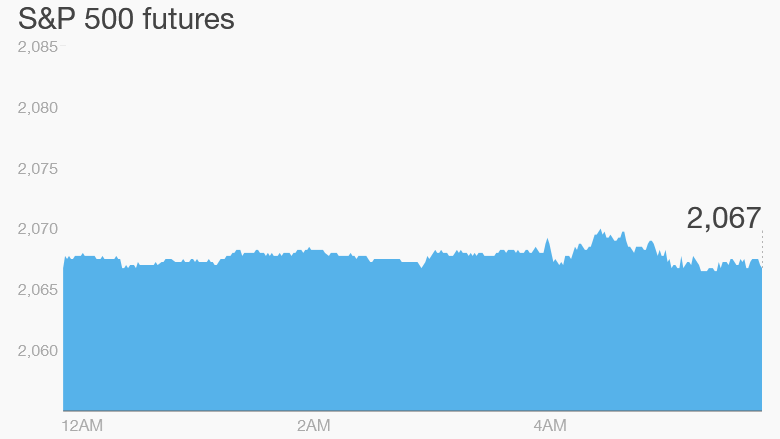

3. Mellow morning for stocks: Investors seem to be in a mellow mood Wednesday. U.S. stock futures are relatively stable. European markets are mixed in early trading. Asian markets also ended with mixed results.

But it's worth keeping an eye on the DAX index in Germany, which is edging lower as anti-austerity protests outside the European Central Bank's new headquarters turn violent.

Looking back to Tuesday, the Dow Jones industrial average lost 128 points, while the S&P 500 fell 0.3% and the Nasdaq rose 0.2%.

4. Stock market movers -- Sony, BMW, Standard Chartered: Shares in Sony (SNE) jumped by 5.5% in Japan after the company announced final third quarter results showing sales and profits were better than preliminary figures reported in February.

Shares in British bank Standard Chartered (SCBFF) are rising by about 7% in London. Analysts have been raising their ratings on the stock, according to reports. Investors have become more optimistic about the struggling bank after it said it would install a new CEO, Bill Winters, who previously worked as the co-head of JP Morgan's (JPM) investment bank.

Shares in BMW (BAMXY) are declining by about 3% in Germany after the automaker posted higher annual sales and profits, but the growth wasn't enough to impress shareholders.

5. Earnings: FedEx (FDX) and General Mills (GIS) are reporting ahead of the open.

Williams-Sonoma (WSM) and Guess (GES) will report after the close.