Wall Street is no longer cheering bad economic news.

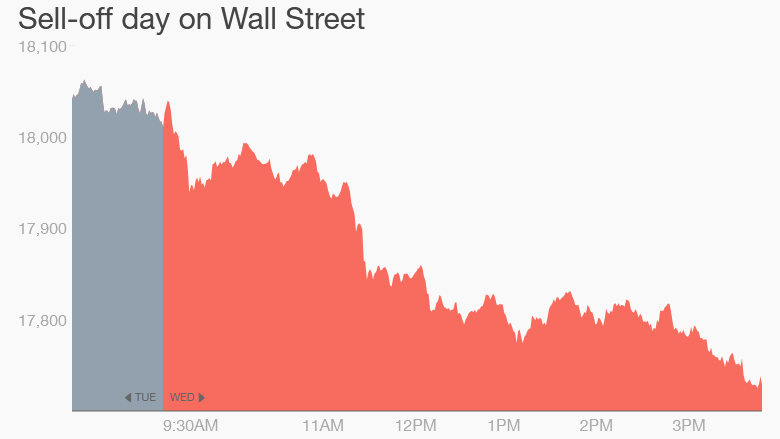

The Dow dropped 292 points and the S&P 500 declined almost 1.5% after the latest in a long line of alarming economic reports.

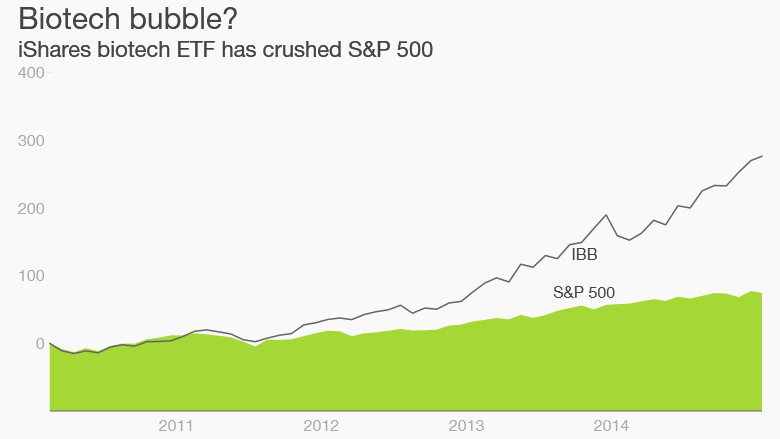

The tech-heavy Nasdaq tumbled over 2.3% -- its biggest drop in nearly a year -- as investors worry that biotechs may be overvalued.

For weeks the stock market rallied because investors saw every economic speed bump as an indication the Federal Reserve would keep interest rates extremely low for longer and longer.

That annoying and somewhat perverse trend ended on Wednesday, at least temporarily.

"You're at a point now where you can no longer say bad news is good news. That's not working anymore. You've got to show some growth here," said Joe Saluzzi, co-head of trading at Themis Trading.

The growth jitters have knocked the stock market well below the levels it soared to last week after the Fed signaled a slow and steady approach to rate hikes.

Related: American cash is flooding into European stocks

Show me the growth: So what's causing the latest sell-off?

Investors lost their appetite for stocks after the government said orders for big-ticket items like refrigerators unexpectedly fell last month. Even excluding volatile transportation items, so-called durable goods orders dipped in February.

This report wasn't a one-off blip either. It comes on the heels of other disappointing indicators, including a surprise decline in retail sales and a steep drop in existing home sales.

Yes, some of the economic turbulence may have been caused by the unusually harsh winter. No matter the cause, the U.S. economy no longer looks as hot as it did heading into 2015.

That's why Wall Street banks are quickly ramping down their growth forecasts. Goldman Sachs (GS) cut its U.S. gross domestic product forecast from 2% to 1.8% for the first quarter, and Barclays trimmed its estimate to 1.2% on Wednesday.

Those are modest trims, but they certainly are not heading in the preferred direction.

Related: Divorce settlement sparks fight between casino owners

Too pricey? All of this renews concerns about whether U.S. stocks have become too expensive. The S&P 500 is currently trading at over 17 times its forward earnings, which is higher than normal, although not at alarm bell levels.

"The market becomes less tolerant of imperfect news" when valuations are this high, said Mark Luschini, chief investment strategist at Janney Capital. "Maybe we're finally at that inflection point where less-than-good-news is not good news."

Part of the worry is companies aren't growing as quickly anymore. There's chatter that the first quarter of 2015 could be the first time since the financial crisis depths that earnings dip. At this point, that's all talk -- investors will get the actual numbers starting in April.

Related: The best performing asset under Obama is...

Biotech bust: Look no further for valuation concerns than the biotech sector. Investors had been clamoring to get a piece of these high-performing stocks, but on Wednesday they took some chips off the table. The iShares Nasdaq Biotechnology ETF (IBB) retreated over 3% and individual names like Biogen (BIIB) and Regeneron (REGN) fell even harder.

"We have the view that the biotech sector has risen to the point where valuations seem egregiously high to us," Luschini said. That makes the group "vulnerable to a rather severe setback," he said.