Spring may be here, but the U.S. economy and corporate America are stuck in winter mode.

When the stock market opens Monday, trading could be brutal. The economy added a mere 126,000 jobs in March, according to the latest data that came out Friday. That was a huge disappointment.

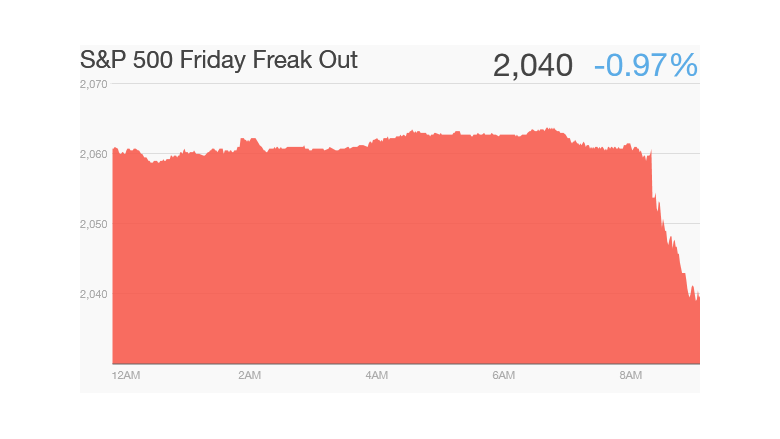

The markets were closed for the holiday weekend, but boy, did things get ugly in the futures market. The Dow, S&P 500 and Nasdaq futures all careened down 1%.

Hiring had been the one really bright spot in the economy with the U.S. averaging over 250,000 job gains a month for about a year.

And then March hit.

It's the latest in a stream of sub-par news. Experts have been slashing their forecasts for economic growth and corporate earnings.

Related: The risks are rising for stocks

Reasons to be queasy: The Federal Reserve Bank of Atlanta started the year predicting 1.9% growth for the first quarter. Last week they cut that forecast to zero.

Businesses are also predicting lousy results. The reporting season kicks off Wednesday with aluminum company Alcoa (AA). Profits for S&P 500 companies are expected to fall for the first time since late 2012.

But it's time for a reality check. Yes, all the signs right now point to April showers -- or even thunderstorms -- but spring can show up quickly in many parts of America, including the stock market.

Warren Buffett warns: No stock market bubble, but few bargains

One bad month doesn't equal a trend. Here are three reasons the economy -- and the stock market -- may still end 2015 in a better place.

1. The "winter blip" happened last year: What's happening right now feels a lot like déjà vu. This time last year things were so dire that the U.S. actually experienced negative economic growth. That sure makes a 0% forecast not sound too bad. The Polar Vortex zapped hiring, spending and just about everything else, but economic activity surged in the second quarter of 2014 with GDP popping 4.6%.

It's easy to see growth accelerating in the spring and summer again this year. Most economists still predict 2.5% to 3% GDP for the year -- that would be above the 2.4% expansion of 2014.

"You got a lot of trend stories at play. Everyone is pointing to the weather," says Sam Bullard, chief economist at Wells Fargo Securities. He also points to the strong dollar and the West Coast port disruption as factors dragging down growth.

The key numbers to watch will be the initial GDP figure for the first quarter, which will come out on April 29, and then the April jobs figure, which will be released on May 8. If either of those are better than expected, sentiment will shift rapidly.

Related: Good news: More workers are quitting

2. April is typically a good month for stocks: Anyone keeping an eye on the Stock Trader's Almanac knows that April is often a very happy month for stocks, at least by the end of it.

The old adage "sell in May and go away" because stocks tend to do little in the summer is a reminder that April is still one of the good months.

Since 2000, there have only been five years when the S&P 500 has had a losing April. Since the financial crisis, only April 2012 was a downturn. Stocks have certainly surged since then.

"The expansion continues to firm, but it may just not be as firm as some people had anticipated," says Bullard. "The markets have incorporated some of this."

The poor economic numbers have been priced in to a certain extent already, so has the impact of the strong U.S. dollar, which has been on its fastest uptick in 40 years against most other world currencies. That's a headwind, but it's a known headwind.

Related: The world's top oil producers

3. A correction is healthy: For long-term investors, the key point to remember is that corrections -- when the market falls 10% or more -- are a normal part of bull markets. They tend to happen every 1.5 years, but we haven't had one since the summer of 2011.

There are even higher expectations that something dramatic will happen once the Federal Reserve raises interest rates. The Fed has strongly hinted it will hike rates in the coming months.

"The standard line is three months or so ahead of the first hike, you can have a 5% to 10% correction," says Daniel Morris, global investment strategist for TIAA-CREF.

Morris notes that more and more experts now think the Fed won't act in June. Instead, the Fed will wait until September, so that might make a possible correction "less imminent." But historically, the "Fed effect" on the market can be short-lived if the economy continues to grow.

If a big sell-off hits this month, it doesn't mean the bull market is over.

As Warren Buffett told CNN's Poppy Harlow last week, "[stocks] may be a little on the high side right now, but they've not gone into bubble territory."