There's plenty going on right now.

Here are the four things you need to know before the opening bell rings in New York:

1. Potential market movers -- Starbucks, Zynga, Alcoa: There are a handful of companies that look set to shake things up when the markets open.

Starbucks (SBUX) shares are perky and caffeinated, up about 3% after the company completed a two-for-one stock split overnight. Starbucks common stock will begin trading on a split-adjusted basis this morning.

Shares in Zynga (ZNGA) could drop sharply after the company announced its founder Mark Pincus has returned to his role of CEO, taking the reins from Don Mattrick. Shares are down 10% in extended trading.

Alcoa (AA) shares are also down about 3% after the company released its latest quarterly results.

"Earnings beat analysts' expectations but sales, on the other hand, were slightly worse," explained Erica Blomgren, chief strategist at Swedish bank SEB.

2. Holy Hang Seng: Traders in Hong Kong are watching in awe after the main stock market index -- the Hang Seng -- shot up by 6.6% over the past two days.

Analysts say investors are turning to Hong Kong after a dramatic 22% surge this year by the Shanghai Composite has made that market too expensive.

Related: The world's hottest stock market is in...

3. Volatile oil: Crude futures keep bouncing around, with oil now up about 2% to trade at $51.50 per barrel.

"Crude prices remain in focus today following yesterday's plunge," said Tom Beevers, CEO at StockViews. "With weekly inventories at the highest level since records began in 1982, traders are monitoring the situation closely and will be expecting more volatility to come."

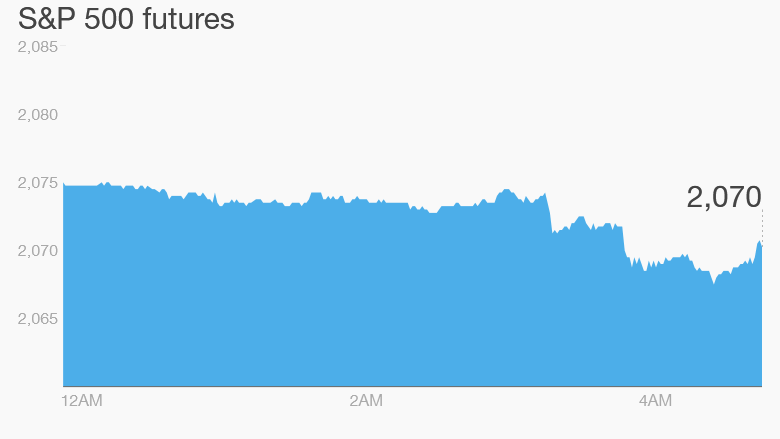

4. Stock market overview: U.S. stock futures are dipping lower, European markets are all edging up in early trading, while Asian markets were mixed.

Investors in Europe are feeling confident that Greece has scraped enough money together to make a big debt repayment Thursday, allowing it to avoid default.

Recapping Wednesday's moves, the Dow Jones industrial average eked out a 0.2% gain, the S&P 500 rose by 0.3% and the Nasdaq jumped by 0.8%.