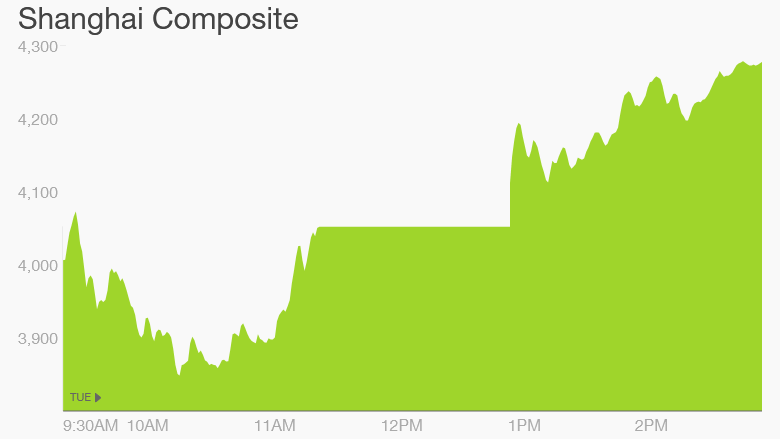

China stocks had another wild day on Tuesday, as volatile momentum swings kept investors guessing about the direction of a market that has lost trillions of dollars of value in recent weeks.

The Shanghai Composite dropped as much as 6% in morning trading, before bouncing back to close up 5.5%. The performance comes one day after China's benchmark index dipped into bear market territory -- defined as a decline of 20% from recent highs.

The smaller Shenzhen Composite, which is heavy on tech stocks, also dropped 6% before mounting a recovery and ending the day with a 4.8% gain.

The dramatic moves are the latest sign that investors remain fearful, and that efforts by Beijing to calm the markets have failed.

The People's Bank of China cut both its one-year lending and deposit rates by 0.25% on Saturday. In an additional move to shore up the economy and reassure investors, the bank also lowered the amount of cash that large banks must keep on reserve by 0.50%.

Analysts at HSBC said that the central bank was trying to engineer a "soft landing" for stocks.

"This could prove to be a difficult balancing act; and, ultimately, to shore up investors' confidence, earnings growth needs to come through and the hefty valuations for small-cap growth stocks have to come down," the HSBC analysts wrote.

Investors shrugged off the bank's decision however, with shares in Shanghai losing 3.3% on Monday.

The China Securities Regulatory Commission took another run at reassuring investors late on Monday evening, issuing a statement that blamed "irresponsible internet hearsay" and critical commentaries for "disturbing market order."

The statement, posted to the agency's official Weibo account, also said that "risks are under control" and recent declines are the result of a normal market correction.

Even with recent losses, the Shanghai Composite has surged 32% this year, and the Shenzhen Composite is up 70%, easily making it the world's top-performing index.

Related: Don't fear China. Fear Washington.

Experts remain generally puzzled by the stock market boom. China's economy is going through a rough patch, with growth now at its weakest pace since 2009. Corporate profits are actually lower than a year ago.

In other words, exuberance for Chinese stocks isn't backed up by fundamentals. Instead, it appears the market is being carried higher by various forms of government stimulus and investor frenzy.

BlackRock analysts describe the market as one where "sentiment rules, while valuation is an afterthought."

"The value of turnover in China's domestic equity markets has more than doubled in 2015, and now often exceeds that of U.S. markets," BlackRock analysts wrote recently. "There are warning signs the ... market has become overheated."

In recent years, people in China -- who tend to save significantly more than their Western counterparts -- sunk their excess savings into the real estate market. Now that the housing market has cooled, investors are turning to stocks.

The market's performance set off something of an investing mania. According to BlackRock, brokers opened four million new accounts in a single week in April.

Of particular concern is an explosion in margin buying -- the practice of buying stocks with borrowed money. Margin debt recently reached a record 8% of the market capitalization, according to Macquarie.

"Old Asia hands know this pattern often ends in tears," the BlackRock analysts said.

-- CNN's Yuli Yang contributed reporting.