Breathe. Grexit will probably not push your bank to its knees.

European markets were hammered on Monday, with the Greek markets closed altogether, after Greece slid rapidly toward default and exit from the eurozone.

But despite the market bloodshed, the Greek default would have limited impact on the global financial system. The risk is now spread out way more than in 2010, the last time Greece got dangerously close to a default.

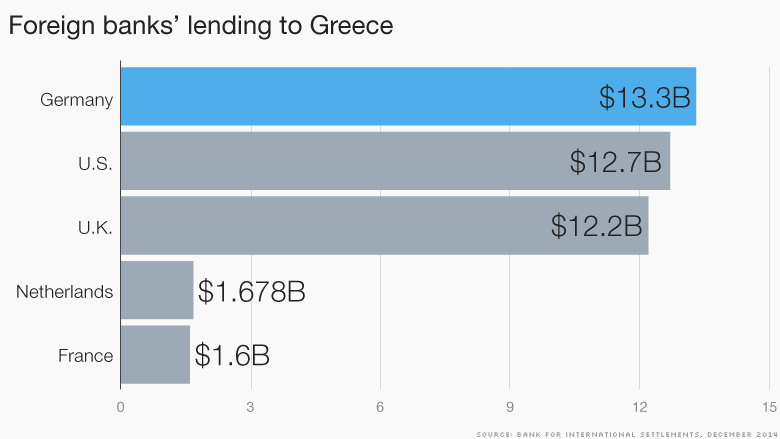

Foreign banks loaned just over $46 billion to Greek banks at the end of 2014. That compares to $300 billion in 2010, according to data from the Bank for International Settlements.

No single bank holds a significant chunk of this debt, so no one creditor would take too much of a hit if Greek banks collapsed.

German, American, and British banks are the most exposed -- German lenders hold around $13.2 billion, and banks in U.S. and U.K. around $12 billion.

While most international investors shunned Greece a long time ago, some fund managers have defied the consensus and bet big on the country, pouring money into Greek banks. These investors are likely to lose big on Greece.

The country's biggest banks have seen their market values wiped out. Piraeus (BPIRF) dropped 57% this year, Alpha Bank (ALBKF) lost 29% and Eurobank (EGFEY) is 22% down so far this year.

7 reasons Grexit wouldn't be a total disaster

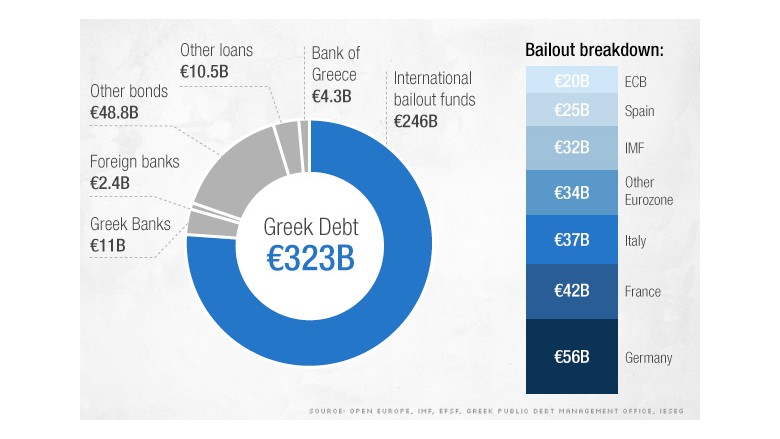

If Greece defaults on its sovereign debt, taxpayers from other eurozone countries would take the hit. Most of Greece's government debt is held by other eurozone countries.

They've loaned the country 142 billion euros through the bailout fund. All eurozone countries chipped into the fund but by far the largest contribution -- 27% -- came from Germany. Another 53 billion euros was loaned through bilateral agreements.