On April 21, People's Daily, the mouthpiece of China's ruling Communist Party, published a bold prediction about the country's benchmark stock index.

The Shanghai Composite had just gone above 4,000 points, and investors were pouring money into the market. Brokers were opening four million new trading accounts a week to meet demand. The newspaper proclaimed the bull market was "just beginning."

The prediction proved right -- for all of a few weeks.

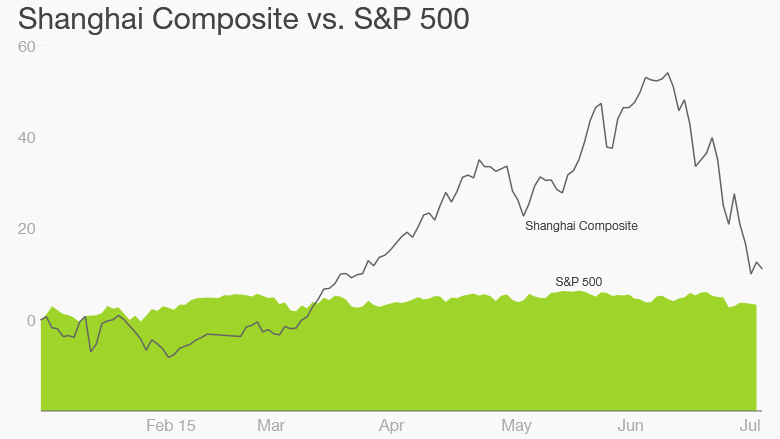

The Shanghai Composite rose above 5150 points, marking an incredible 150% gain in a year.

Then the bottom fell out. Since June 12, the Shanghai Composite has lost an unnerving 30%. Losses were heavy again on Wednesday, after a brutal open.

What happened? Experts identify several causes. China's slowing economic growth is one. Risky trading practices are another. All along, bullish propaganda by China's state-run media helped drive people to invest.

State media outlets wield enormous influence in China. Their stories and editorials are pored over for clues on government policy. If newspapers and websites support buying stocks, the thinking goes, so must policymakers in Beijing.

The People's Daily story said the bull market was justified because the government was pushing hard on economic reforms, which had support from all corners of society. Booming markets, it said, were a natural response to this economic growth.

"The common perception since last summer has been that the government wanted a sustained rally and would act to keep it going," Mark Williams of Capital Economics said. "Official media were trumpeting the markets' rise and even suggested that skepticism about it reflected a lack of confidence in the leadership's plans for economic reform."

The crash comes in June

Now it's not only the Shanghai Composite that is crashing. The bears are growling even louder on the smaller Shenzhen Composite, down roughly 40% in the same period.

The popularity of margin trading -- the practice of buying stocks with borrowed money -- is thought to have accelerated the sell off.

When margin bets go sour, investors are forced to quickly pay back huge amounts of cash, or liquidate their trading accounts. Buying on margin is incredibly risky, but has become commonplace among retail investors in China.

The most compelling theory why the bubble burst: Chinese economic growth is the weakest it's been since 2009. Share prices got way ahead of growth and company profits, which are actually lower than a year ago.

Related: Greek crisis is nothing compared to China

Beijing responds

The government is now doing everything it can to rescue the markets. The People's Bank of China has cut interest rates to a record low, brokerages have committed to buy billions worth of stocks, and regulators have announced a de-facto suspension of new IPOs.

The measures are producing a lopsided recovery, with some stocks faring better than others.

China's huge state-owned enterprises are finding strong support -- shares of oil and gas producer PetroChina, for example, have gained 27% over the past four trading sessions, even as crude prices plunge.

On Tuesday, many other state-owned companies, including the biggest banks and industrial firms, gained exactly 10% -- the daily market limit. Meanwhile, the vast majority of stocks lost ground.

Analysts say shares of state-owned companies are rising because government-backed funds are now buying their shares. The tactic, critics say, runs contrary to Beijing's stated commitment to allow market forces more influence over stocks and the broader economy.

"My view is that the whole Chinese financial system runs on the assumption that it's too big to fail," said Patrick Chovanec, managing director at Silvercrest Asset Management.

State media sends a new message

Every disaster needs a scapegoat. And for this one, state media is focusing on short sellers -- or investors who bet that shares will drop. Regulators have threatened in recent days to prosecute anyone found to be engaged in market manipulation.

But otherwise, the message is one of reassurance.

"Firm confidence instead of panic should be held for China's capital market as market risks are within control and fragile market sentiment will be reversed," People's Daily wrote in a commentary. "Continued efforts should be made to ensure a long and stable development of the capital market."

Still, there are signs that state media hasn't kicked its market prognostication habit. On Sunday, Xinhua published a story titled "Chinese stock market likely to bottom out: experts."

On Monday, stocks plunged. On Tuesday, they plunged again.

-- CNN's Katie Hunt contributed reporting.