It's another big day for earnings.

Here are the five things you need to know before the opening bell rings in New York:

1. Earnings tsunami: Get ready to be hit by a wall of summer earnings reports.

Companies reporting before the trading day begins include McDonald's (MCD), 3M (MMM), Caterpillar (CAT), Comcast (CCV), General Motors (GM), Dunkin Brands (DNKN), Southwest Airlines (LUV), Dr. Pepper (DPS), Under Armour (UA) and Eli Lilly (LLY).

Companies reporting after the market closes include Starbucks (SBUX), AT&T (T), Amazon (AMZN), Capital One (COF), TripAdvisor (TRIP) and Visa (V).

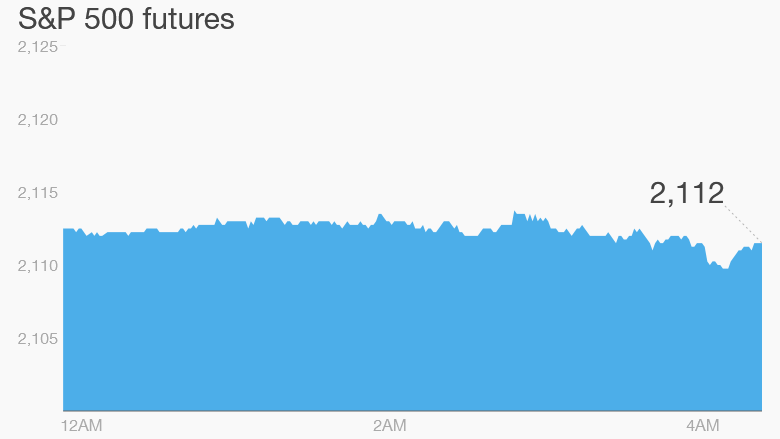

U.S. stock futures were holding steady ahead of the deluge of results.

2. Movers -- American Express, Qualcomm, SanDisk, Credit Suisse: Shares for American Express (AXP) and Qualcomm (QCOM) are both slipping by about 2% in extended trading after releasing lackluster quarterly earnings Wednesday. Qualcomm also announced plans to lay off 15% of its workers.

SanDisk (SNDK) is seeing a 13% boost in its share price premarket after it reported earnings per share that were double analysts' expectations.

In Europe, shares in Credit Suisse (CS) were rising by about 5% after the bank reported better-than-expected results.

Related: Apple has $203 billion in cash

3. Economics: The U.S. Department of Labor is reporting weekly unemployment claims data at 8:30 a.m. ET.

As it stands now, initial and continuing unemployment claims are at the lowest levels seen in roughly 15 years.

4. International markets and commodities: European markets are broadly positive in early trading, though the moves have been muted.

Greece passed a number of new economic reforms overnight, clearing the way for detailed negotiations to begin on a new bailout package worth as much as 86 billion euros ($94.5 billion).

Asian markets ended with mixed results.

Commodities remain in focus. Gold and oil are inching back up after recent sharp losses.

Crude prices have dropped from a recent high of $61.43 to trade around $49.50 per barrel. Crude futures were trading 0.5% higher.

Gold prices are up 1% this morning, but are still trading at five-year lows.

5. Wednesday market recap: Wednesday was a negative day. The Dow Jones industrial average lost 0.4%, while the S&P 500 was down 0.2% and the Nasdaq sunk 0.7%.