There's a company that helps you get from point A to point B that's already public, profitable and worth more than Uber!

Priceline.

The online travel company reported earnings Wednesday that blew away Wall Street's forecasts, sending Priceline's stock up 6%. It hit a new all-time high of nearly $1,400 a share before pulling back a bit.

That's not a misprint. Priceline (PCLN) is the highest-priced stock in the S&P 500 ... by far. Chipotle (CMG) is second, trading around $750 a share.

Priceline's market value is now around $70.5 billion -- almost $20 billion higher than Uber.

Related: Uber is now the most valuable startup in the world

The online travel business has been booming along with the airline industry for the past few years.

Consumers are flying a lot more these days -- for business and pleasure. So they are naturally looking for cheap fares on sites like Priceline and Expedia.

In fact, Expedia (EXPE) has been an even better performer than Priceline lately. Its stock is up 50% this year, compared to a 20% jump for Priceline. Expedia announced earlier this year that it was buying smaller online travel company Orbitz (OWW) and also acquired Travelocity from Sabre (SABR) in January.

But back to that sticker shock-inducing stock price. Why does one Priceline share cost more than a new MacBook?

It's mainly because Priceline hasn't issued more shares in order to lower the price. It's called a stock split. Many companies do that when their share price gets into the triple digits -- let alone quadruple digits.

Only three stocks in the U.S. have a higher share price -- homebuilder NVR (NVR), food and transportation company Seaboard (SEB)(it co-owns Butterball) and the A shares of Warren Buffett's Berkshire Hathaway (BRKA) -- which famously trade for more than $200,000 a pop. (Mere mortals can buy the Berkshire B (BRKB) shares for just $144 each.)

Apple (AAPL) and Netflix (NFLX) recently did stock splits when their shares were trading around $700. That cut the price of each share back to around $100 to make them more affordable for mom and pop investors.

Related: Netflix stock just got 'cheaper'

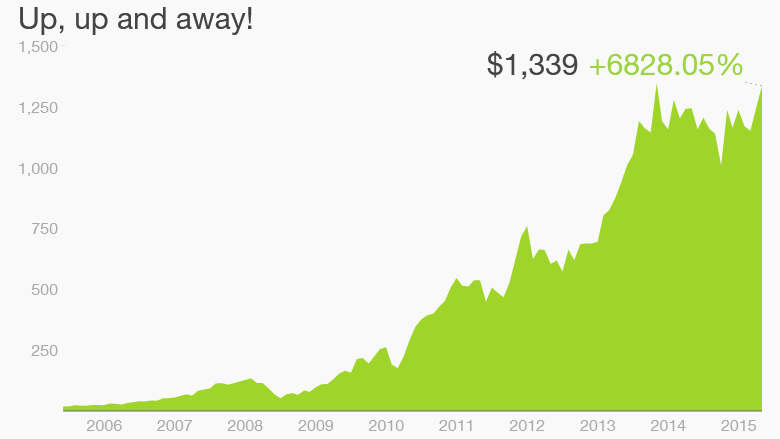

But Priceline's refusal to split its stock clearly hasn't scared away investors. Shares are now up nearly 7,000% in the past decade -- well ahead of the Nasdaq.

Priceline's success is even more remarkable when you consider that it was left for dead when the dot com bubble burst in 2000.

The company went public in 1999 and quickly doubled before imploding with the rest of the tech sector. It lost nearly all its value by the end of 2002.

Things got so bleak that Priceline actually did wind up doing the only stock split in its history in 2003 -- a reverse stock split. Priceline reduced the number of shares outstanding to prop up the stock price.

That's usually a Hail Mary by companies worried they will be delisted -- or worse. But it actually worked.

Flash forward a dozen years and Priceline is now a global leader in online travel that has evolved beyond the name-your-own-price gimmick that it was once known for -- although William Shatner remains the company's main spokesperson. Thank heavens. (Don't short the Shat!)

Priceline has expanded through some savvy acquisitions.

The purchase of Booking.com made it a big player in Europe. It also has acquired Rentalcars.com, travel search engine Kayak and restaurant reservation site OpenTable.

Priceline is growing in Asia as well thanks to its acquisition of Asian hotel reservation site Agoda and its investment in China's Ctrip (CTRP) -- which just reported strong quarterly results this week.

The company is expecting the good times to continue.

Priceline CEO Darren Huston said in the earnings release that "the summer travel season got off to a strong start." Customers booked $15 billion in airfares, hotel reservations and other travel services in the second quarter.

Huston added that the third quarter could be "the largest quarter in our company's history."

Wall Street is even more bullish. Cantor analyst Naved Khan, who has a buy rating on Priceline, said that the company's third quarter outlook might even be a little conservative.

Related: Expedia buys Orbitz for $1.6 billion

And even though Priceline's stock has had an amazing run, it's not as expensive as you might think.

Shares trade for 24 times this year's earnings forecasts, which seems reasonable considering that analysts are predicting annual earnings increases of about 18% for the next few years.

Expedia trades for 30 times earnings forecasts, even though its growth rate is about the same.

So don't sweat the high stock price. Priceline at more than $1,300 a share appears to be a better bargain than Expedia at about $125.