Get ready! It's going to be an exciting day for investors.

Here are the five things you need to know before the opening bell rings in New York:

1. China's currency moves: The Chinese yuan dropped sharply against the U.S. dollar overnight after China's central bank announced a surprise policy change.

The central bank said it decided to allow market forces greater control over the yuan, and announced a major change in how the currency's daily "fix" or "midpoint" will be calculated.

The sudden devaluation is the largest in two decades, and comes amid a period of slower economic growth and increased stock market volatility in China. A devalued currency will give a boost to Chinese exporters and lend support to the wider economy.

2. Google shares set to surge: Google (GOOGL) stock is rallying about 6% premarket after the tech giant announced a massive restructuring plan.

Google is going to have a new parent company -- called Alphabet -- that will separate its Internet based business from its research undertakings. The company is also making some management changes.

Both the voting-class GOOGL (GOOG) shares and other GOOG (GOOSY) shares will switch automatically to Alphabet stock when the restructure rolls out later this year. The ticker symbols will remain the same.

Related: Meet Google's new CEO

3. Greek bailout 3.0: Greece and its eurozone partners are poised to finalize a third bailout deal worth about 86 billion euros ($95 billion).

Negotiators had been trying to iron out some final details over the last few days. A spokesperson for the Greek Finance Ministry told CNN that negotiations have wrapped up.

The bailout is intended to help Greece pay its debts and reform its economy after years of overspending and financial mismanagement. Greece has already received two previous bailouts worth 233 billion euros ($257 billion).

4. Stock market overview: European markets are mostly declining in early trading, though Greek stocks rose 1.5% as the country moved closer to securing a new bailout.

Shares in British fashion house Burberry (BBRYF)sank nearly 3% as investors worry that a weaker Chinese currency will hurt sales in this key market.

Asian markets broadly finished the day in the red.

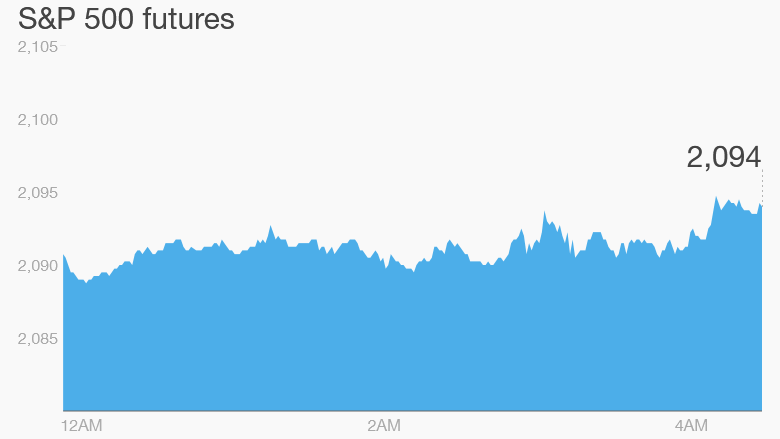

U.S. stock futures are pointing down. But the Nasdaq is bucking the trend and holding steady ahead of the open, supported by Google's premarket jump.

It follows a positive session for U.S. stocks Monday. The Dow Jones industrial average, S&P 500 and Nasdaq all gained more than 1%, after many days of losses.

5. Earnings and economics: Red Robin (RRGB) is among the companies reporting earnings ahead of the open. Then after the close, Fossil (FOSL) will release results.

On the economic front, the federal government will release new data on U.S. business production costs and productivity at 8:30 a.m. ET. Productivity was down 3.1% in the first quarter, and analysts think that trend could continue.