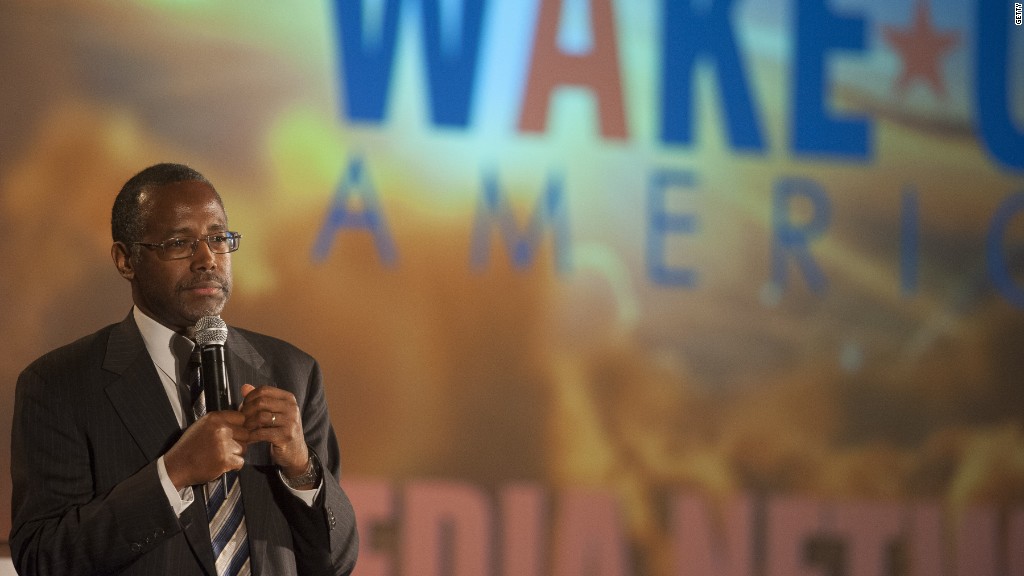

Ben Carson has surged to second place among the Republicans vying to be the next president of the United States.

As a doctor, Carson casts himself as the ultimate political outsider -- even more so than Donald Trump.

He blames Washington politicians for the nation's massive $18 trillion debt load.

"$18 trillion...think about what that means," Carson likes to say. "We're putting that on the backs of people coming behind us."

It's an old strategy from the Republican political playbook to campaign on balancing the U.S. federal budget. But Carson knows how to explain the debt problem in a way that America hasn't really seen since Ross Perot was holding up charts in the 1990s during his presidential bid.

"If you tried to pay that [debt] back at a rate of $10 million a day, it would take you over 5,000 years," Carson said in his campaign announcement.

Related: U.S. tax revenues at record high. Who's paying?

His math is basically correct, according to Doug Holtz-Eakin, a former head of the non-partisan Congressional Budget Office.

There's just one problem: Carson doesn't really address how he'll get the debt under control.

Carson wants to change the Constitution with an amendment requiring a balanced budget every year, but he provides little detail on how he'll cut costs or raise more revenue to reach that goal.

"I'm thrilled that any candidate is concerned about the debt load," says Holtz-Eakin, now president of the right-leaning American Action Forum. "But you can't address it unless you talk about what you're going to do with entitlement programs."

The bulk of America's inability to balance the budget "is mainly attributable to significant growth in spending on health care and retirement programs," according to the latest CBO report.

So far, Carson hasn't addressed either Social Security or Medicare this campaign cycle.

Related: Ben Carson slams Trump's 'double whammy' immigration plan

He says there are other priorities.

"I don't think we should even talk about entitlements until we fix the economy, and I think fixing the economy is not going to be that difficult," he said in May.

Carson's thinking has been criticized as naive. Not addressing entitlements means the U.S. is headed for a "debt spiral" in the coming years, Holtz-Eakin says.

In addition to not discussing spending cuts, Carson has become the leading champion among 2016 contenders of a flat tax, where all Americans face the same income tax rate.

In the first GOP debate on Fox, Carson suggested that rate should be around 10%, much like tithing at church because "I think God is a pretty fair guy."

Carson hasn't fleshed out enough for a tax policy for experts to really run the numbers. But it's hard to make the math add up to enough money to pay annual government expenses, let alone start paying down the debt, with a 10% flat tax.