Congress may have averted a government shutdown until December 11, but lawmakers will be under the gun to raise or suspend the debt ceiling long before then.

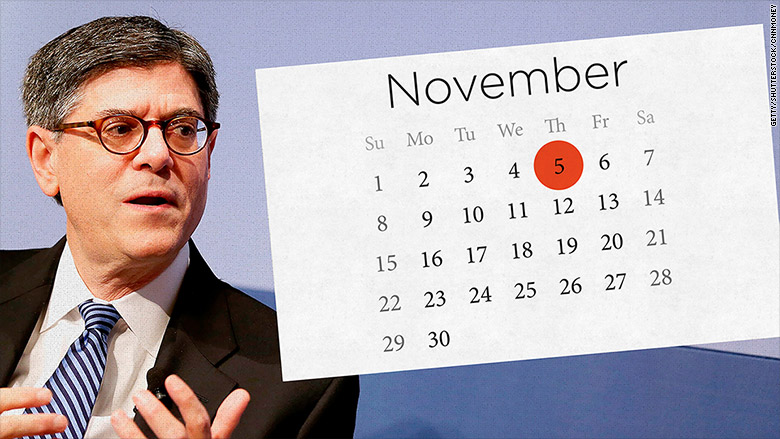

Treasury Secretary Jack Lew said Thursday he now estimates that "on or about" November 5, Treasury is likely to exhaust special accounting measures that are keeping the country's debt below its legal limit.

At that point, the Treasury Department would only be able to pay the country's bills with the cash it has on hand -- which Lew expects to be roughly $30 billion.

And that would not be enough to cover the bills on some days, which can amount to $60 billion.

"We anticipate that our remaining cash would be depleted quickly," Lew wrote in a letter to House Speaker John Boehner.

Lew stressed if that happens, it would be the first time in the country's history that the United States could not meet all of its obligations.

"There is no way to predict the catastrophic damage that default would have on our economy and global financial markets," he added.

Related: Key Senate Republican wants major fiscal deal

Here's what he's talking about: To pay bills and benefits in full and on time, Treasury borrows money to make up the difference between what it spends and what it takes in.

If Congress doesn't act in time to raise or suspend the nation's borrowing limit, currently set at $18.113 trillion, Treasury will not be able to borrow to fulfill all its payment obligations.

The fallout from that is unknown, but it could be very harmful.

Most experts think Treasury would do all it could to prioritize interest payments on the country's debt, lest the United States default on its bonds, since that would likely send markets plunging and interest rates soaring.

But it's not clear how investors would respond if Treasury makes interest payments but delays payments to government contractors, federal workers, taxpayers due refunds, veterans, seniors and anyone else to whom the federal government has a legal obligation.

Related: 7 things you need to know about the debt ceiling

November 5 is just a few days after House Speaker Boehner will retire from Congress, a move he announced unexpectedly last Friday.

Boehner's departure complicates the process of the budget and debt ceiling negotiations ahead. Conservative lawmakers have cheered Boehner's departure, and some may now push even harder for the spending cuts that they've wanted in exchange for their votes to raise or suspend the debt ceiling.

Or it's possible that Boehner may try to tie a bow on it before he leaves. Bipartisan congressional leaders have been in discussions about putting together a long-term funding bill that could also raise the debt ceiling through the 2016 presidential election.

The absolute-drop-dead-date on the debt ceiling - sometimes called the "X" date - is the day when Treasury runs out of cash after it exhausts its special accounting measures. That day could come between mid- and late-November, according to the Bipartisan Policy Center, which has had a good track record of making such estimates.

All estimates - including Lew's - are inherently uncertain given how variable Treasury's inflows and outflows can be on any given day. That's why the longer Congress waits to make a decision, the greater the risk it runs that Treasury will be caught short and have to default on a payment.

-- CNN's Deirdre Walsh and Manu Raju contributed to this story.