Colombia could end a 50-year guerilla war soon, and profit may bloom from the peace.

Last week, the Colombian government and leaders from the Revolutionary Armed Forces of Colombia (FARC) reached a key tentative agreement on a peace deal. They're scheduled to officially sign the agreement in March.

If signed, the deal would end a conflict that's killed over 200,000 people, forced many more into poverty and put a dark cloud over Colombia and its history.

Peace would be a crowning achievement for Colombia as it wrestles off its old image as a drug haven and projects itself as an economic powerhouse in its region.

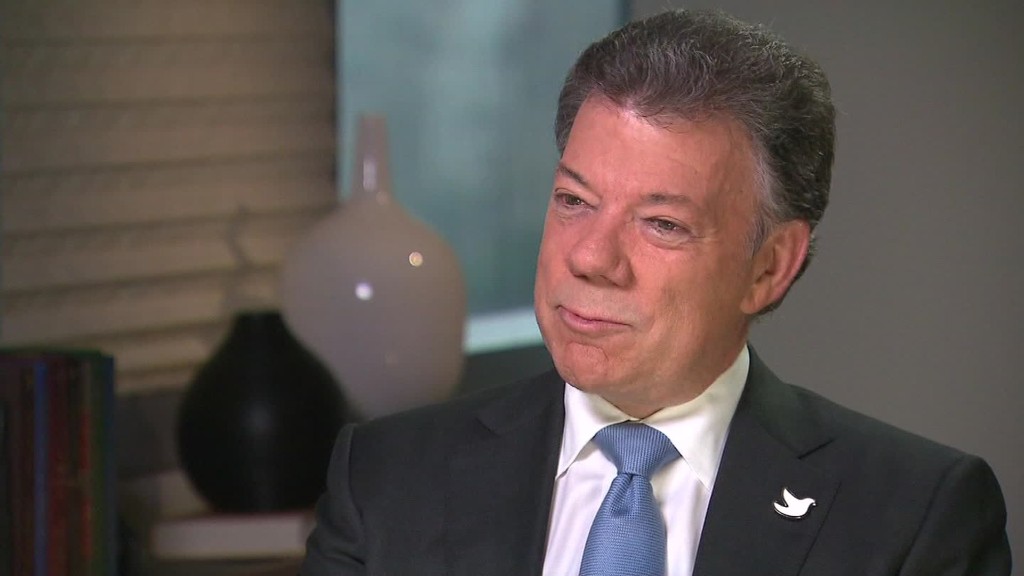

Beyond the humane and moral benefits of peace, Colombia's President, Juan Manuel Santos, and some independent economists say that the peace deal, if signed, will spur more economic growth in Colombia.

"The impact on economic growth is going to be very positive," Santos said Wednesday at an event hosted by the Council of the Americas in New York. "We're going to have an even better performance when peace is reached."

Related: Colombia: from murder capital to Latin America's Silicon Valley

Santos argues that a peace deal, if finalized, would increase foreign investors' confidence in Colombia, open up even more of the country's rich farmland and create jobs.

Last year Colombia's economy grew 4.5% -- one of the best in Latin America. Santos says GDP could get a 1.5% annual boost after a signed peace agreement.

Incomes for Colombians would be 43% higher today if the peace had been signed in the 1980s when FARC and the Colombian government first began talks, argues Jorge Restrepo, the director of the Conflict Analysis Resource Center, a Colombian think tank.

"If the peace would have been made in 1984, during all those years [after] we could have had the income level that Mexico and Uruguay have today," Restrepo wrote in a report for the Colombian government. (Mexico and Urugay's economic output per person -- also called GDP per capita -- is above $10,000 while Colombia's is just below $8,000).

Some economists say the impact will be more modest over the next two to three years. The real financial win in the near term could be for those who invest in Colombia.

"If and when the agreement is signed and sealed, financial markets will undoubtedly rally," says Edward Glossop, emerging market economists at Capital Economics.

Related: The next domino to fall: Latin America

Glossop cautions that the deal isn't signed yet, key details still need to be ironed out and the agreement must go through a referendum vote with Colombians. He estimates that a near term boost in economic growth would be more modest than Santos' prediction -- closer to 0.5%.

While any economic boost would be welcomed, others echo a similarly tempered chord: Colombia may not see a significant boost to economic growth next year because it's already benefited economically over the past decade as the conflict with FARC has gradually deescalated.

Although the peace agreement is the right thing and it has economic benefits, implementing the peace will be financially expensive, says Francisco Rodriguez, Andean economist at Bank of America Merril Lynch. It could result in tax increases for ordinary Colombians, he argues.

"A great part of these benefits have already been reached by the Colombian economy," says Rodriguez.

But Colombia's finance minister, Mauricio Cardenas, strongly disagrees. He says Colombia still has lots of undeveloped farmland and oil reserves that it will churn into economic growth. Tourism should be higher too, he argues.

"We have vast parts of the country that haven't been developed," Cardenas told CNNMoney Monday. Peace will also help bridge the economic inequality gap between Colombia's wealthy cities and poor rural regions. "Incomes are going to go up on a permanent basis."

Colombia's economy -- more diverse than others in Latin America -- has weathered a tough storm this year of falling commodity prices, slow global growth and investor flight from emerging markets. Still, its economy still grew 3% in the second quarter this year, exceeding expectations.

Related: Mexico is Latin America's success story as Brazil stumbles

Colombia has been one of the best performing economies in Latin America in recent years. But the oil price plunge, slowing global economy and looming rate hike from the U.S. Federal Reserve are causing investors to pull money out of Colombia and the region this year.

Colombia's currency has fallen 22% against the dollar in 2015 and its stock market is one of the worst performers globally this year. The peace agreement could create some much needed economic tailwinds. And more importantly, it would save lives.

"War is always more costly than peace," Santos said. "In Colombia, we are fed up with war and we want peace."

Correction: A previous version of this story misstated the title of Jorge Restrepo as a professor at the University of London. He obtained his PhD at the university, but is not a professor there.