It's all about earnings today.

Here are the five things you need to know before the opening bell rings in New York:

1. Flood of earnings: A number of important earnings are coming through this morning from 3M (MMM), Caterpillar (CAT), Dunkin' Brands (DNKN), McDonald's (MCD) and Southwest Airlines (LUV).

United Continental (UAL) is also reporting this morning. These are the first results since the new interim CEO took over after CEO Oscar Munoz suffered a heart attack and took a medical leave of absence.

After the closing bell, AT&T (T) will post its first results since merging with DirecTV. Google will issue its first results as Alphabet (GOOG). And the markets will hear from Amazon (AMZN) and Microsoft (MSFT).

In Europe, the parent company for Mercedes-Benz cars -- Daimler (DDAIY) -- reported record sales in the third quarter and strong growth in China. Many other automakers have experienced slower sales in China as the economy slows and the government cracks down on officials who make lavish purchases.

2. Market movers -- eBay, Texas Instruments: Solid earnings reports on Wednesday afternoon from Texas Instruments (TXN) and eBay (EBAY) boosted their stock prices in after hours trading. Both were up nearly 10%.

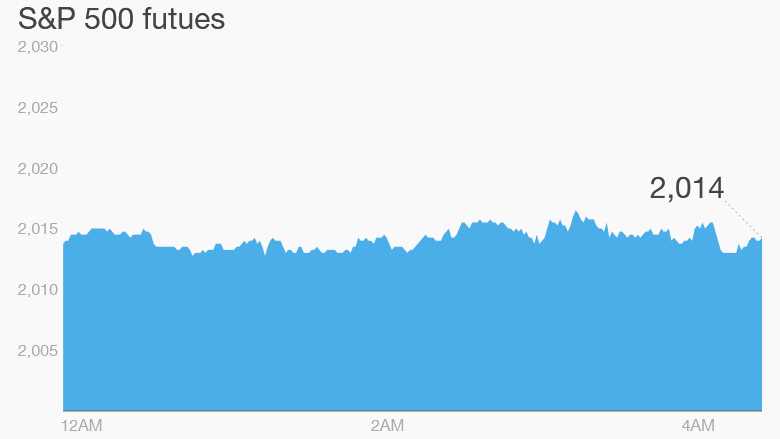

3. Stock market overview: U.S. stock futures are inching higher ahead of the open. But the mood could change depending on whether investors cheer or boo the latest quarterly results.

European markets are mixed in early trading.

Chinese stock markets closed the day with gains, but most other Asian markets took a dip.

4. Economics: The European Central Bank is announcing its interest rate and monetary policy decisions at 7:45 a.m. ET. It's highly unlikely to make any new moves but many economists think the bank will hint at printing more money in the future to combat deflation in the region.

"Markets seem positioned for a dovish outcome, perhaps via rhetoric setting the stage for stimulus expansion in December," said Ilya Spivak, a currency strategist at DailyFX.

In the U.S., weekly jobless claims figures will come from the federal government at 8:30 a.m. ET.

At 10 a.m., watch for new existing home sales data from September. The last report from the National Association of Realtors showed sales were down 4.8% in August.

5. Wednesday market recap: It was a relatively calm day for U.S. stocks on Wednesday, apart from a major drop in Valeant (VRX) shares and an IPO from Ferrari (RACE).

The Dow Jones industrial average dipped 0.3%, the S&P 500 declined 0.6% and the Nasdaq lost 0.8%.