Welcome to red Wednesday, brought to you by crashing oil prices.

Investors were seeing red in Tokyo, where the Nikkei has entered bear market territory. There was more red in Europe, where commodity shares are suffering. In oil markets, too, prices are falling.

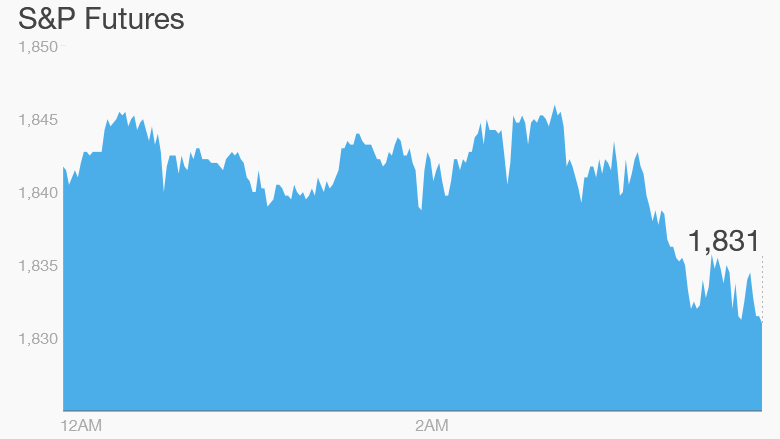

U.S. stock futures are also sharply lower.

Here are the five things you need to know before the opening bell rings in New York:

1. International markets overview: European markets are sharply lower, with main indexes down around 3% lower at the open. Asian markets ended firmly in negative territory. The Nikkei closed down 3.7%, and entered a bear market. The Hang Seng ended down 3.8% and shares in Shanghai shed 1%.

2. Oil: The crash in crude oil prices keeps getting worse, heightening concerns about the health of the world economy. Oil in the U.S. has fallen below $28 a barrel for the first time since September 2003.

3. Stock market movers -- Shell, Netflix, IBM: Shell (RDSA) shares are down more than 3% after the oil major gave a downbeat market update ahead of a shareholder's vote on its proposed merger with BG (BRGYY).

Netflix (NFLX) shares surged more than 6% during extended trading after the company revealed it reached 75 million subscribers last quarter.

IBM's (IBM) shares were down 5% premarket after the company issued a disappointing earnings report.

4. Earnings: Companies including Goldman Sachs (GS) and TE Connectivity (TEL) will post their quarterly earnings updates before the opening bell. Kinder Morgan (KMI), Logitech (LOGI) and Raymond James Financial (RJD) will issue results after the market close.

5. Tuesday market recap: The Dow Jones industrial average advanced by 0.2%, while the S&P 500 inched up 0.1% and the Nasdaq dipped 0.3%.