A moment of calm?

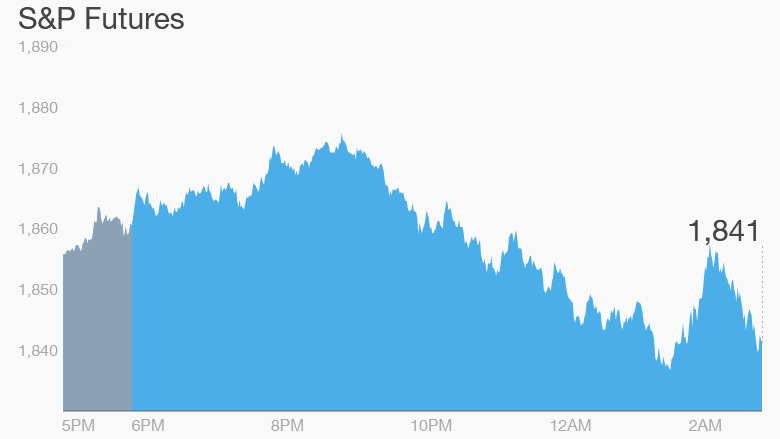

Asian markets closed firmly in the red on Thursday, but Europe appears to be taking a pause and indexes are all up over 0.5%. Oil firmed at around $28 a barrel after a sharp decline Wednesday. U.S. stock futures are flat. Oh, and the European Central Bank meeting.

Here are the six things you need to know before the opening bell rings in New York:

1. European Central Bank: The ECB kept interest rates and its quantitative easing program unchanged, as expected. However, Mario Draghi made clear he was ready to pump more money as soon as March if necessary. French and German stock markets are up about 1.6%. The ECB disappointed markets with muted action after meeting in December.

2. International markets overview: European markets are mixed in early trading, while Asian markets closed with losses. The Hang Seng ended the day 1.7% lower, the Nikkei closed down 2.4% and Shanghai shed 3%.

3. Stock market movers -- Sharp, Pearson, IBM: Sharp (SHCAY) shares soared 5.5% in Tokyo on reports that Foxconn might buy the troubled tech firm. Publisher Pearson (PSORF) jumped 10% at the start of trading after announcing a restructuring which includes cutting 10% of its workforce. IBM (IBM) is down around 5% in premarket trading as its shares continue to fall after poor results.

4. Earnings: Investors will hear from companies including Verizon (VZ), United Continental (UAL), Travelers (TRV), Union Pacific (UNP) and Southwest Airlines (LUV) before the opening bell.

After the market closes, another round of earnings reports will include American Express (AXP) and Starbucks (SBUX).

5. Economics: A weekly report on jobless insurance claims in the U.S. is due from the federal government at 8:30 a.m. ET.

Also at 8:30 a.m., the Philadelphia Federal Reserve will issue its manufacturing index for January. Last month the index slipped back into contraction mode with a -5.9 reading.

Finally, Wall Street will be watching for new data on U.S. crude inventory levels, expected at 11:00 a.m.

6. Wednesday market recap: After sharp falls, the Dow Jones industrial average ended the day with a 1.6% loss, while the S&P 500 was down 1.2% and the Nasdaq dipped 0.1%.