It's a new week, but the same old January jitters remain on Wall Street.

Here are the four things you need to know before the opening bell rings in New York:

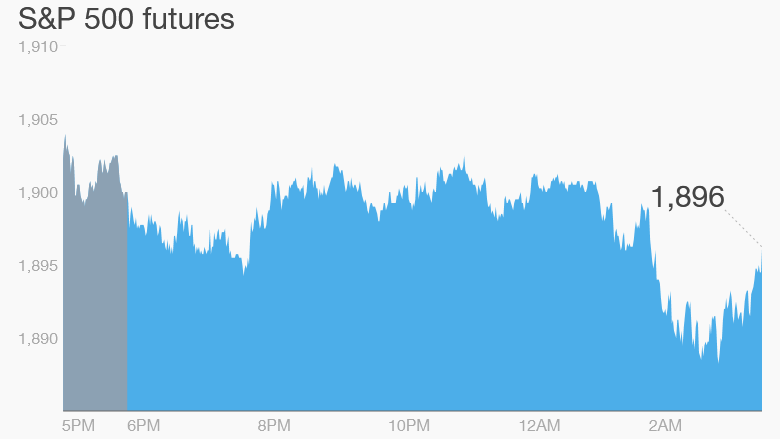

1. Oil and stocks resume slide: The price of oil is dropping again, which is putting pressure on U.S. stock futures and European markets.

Crude oil futures are falling by about 3% to trade around $31 per barrel.

The latest oil price drop is being blamed on Saudi Arabia's state-run oil company, Saudi Aramco. The energy heavy hitter reportedly said it was continuing to invest in energy projects despite oversupply in the markets.

Wild fluctuations in the price of oil have spooked investors over the past few weeks.

Crude oil prices dipped below $27 per barrel last week, hitting lows not seen in over a decade. The price then shot up at the end of the week, helped by cold weather in the U.S., which boosts demand for heating oil.

Meanwhile, Asian markets ended the day with solid gains. The main Australian ASX All Ordinaries index led the way higher with a 1.8% jump.

Related: What it costs to produce oil

2. Earnings: A wide range of big U.S. companies are reporting earnings this week.

McDonald's (MCD), Halliburton (HAL) and Kimberly-Clark (KMB) kick things off by reporting results ahead of the open.

Then, after the close, Wall Street will hear from Steel Dynamics (STLD), Packaging Corp (PKG) and J&J Snack Foods (JJSF), which is the company behind ICEE drinks.

3. Stock market movers -- Tyco International, Takata, Twitter: Shares in the security firm Tyco International (TYC) are surging by about 7% premarket based on reports that Johnson Controls (JCI) is considering a $20 billion takeover of the company. An announcement could come as early as Monday.

Shares in the beleaguered Japanese auto parts company Takata (TKTDY) dropped by 10% Monday after U.S. regulators said another 5 million vehicles with the company's faulty airbags would have to be recalled following another death linked to the airbags.

Shares in Twitter (TWTR) are looking a bit weak Monday following revelations about a management exodus. Four of the company's top executives are departing.

4. Friday market recap: Thanks in part to a rebound in crude oil prices at the end of last week, the Dow Jones industrial average gained 211 points, or 1.3%, on Friday. The S&P 500 was up a full 2% and the Nasdaq added 2.7%.