Oil is falling again and Apple has warned of slowing sales and a challenging global environment.

It could be another rough day for markets.

Here are the six things you need to know before the opening bell rings in New York:

1. Bad Apple?: Apple reported its most profitable quarter ever on Tuesday, but the results show it has reached the end of an era of unprecedented growth.

"This is a huge accomplishment for our company, especially with the turbulence around us," CEO Tim Cook said on a conference call with analysts. "The challenging global macroeconomic environment is leading to constrained conditions unlike anything we've seen, everywhere we look."

Apple said it expected sales in the current quarter will fall for the first time in 13 years. Its shares are dipping by 3% ahead of the open.

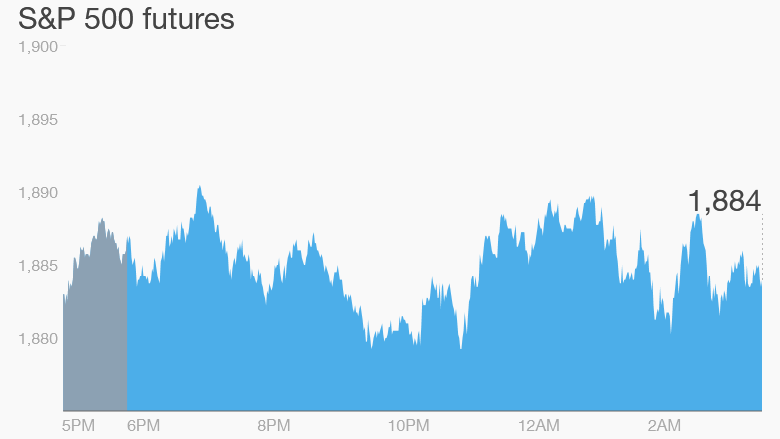

2. Oil shakes markets: U.S. stock futures are dipping again and European markets are slipping in early trading, moving in lock-step with declining oil prices.

The correlation between oil price moves and stock markets has been jarring for many long term investors. U.S. oil futures were down nearly 4% around $30 a barrel.

Set your watch to 10:30 a.m. ET when new data on U.S. crude oil inventories come out, which could have further impact on prices and overall market sentiment.

3. Fed focus: The Federal Reserve is due to release its latest monetary policy decision at 2 p.m. after a two-day meeting.

Wall Street will be watching for hints about the central bank's plan for interest rates in 2016, but most investors don't expect to see another rate hike this month.

4. Earnings: A range of major global companies will be posting earnings before the opening bell rings, including Fiat Chrysler Automobiles (FCAM), Ericsson (ERIC), Boeing (BA), Progressive (PGR) and Tupperware (TUP).

Another round of reports are due after the market close from companies such as Facebook (FB), eBay (EBAY) and Qualcomm (QCOM).

5. HSBC considers new home: HSBC's (HSBC) board is starting a two-day meeting Wednesday to discuss whether to move the bank's headquarters out of London.

The bank said last year that it was considering moving out of the U.K. because of tough regulations and uncertainty over the country's future in Europe.

6. Tuesday market recap: It was a positive day for stocks on Tuesday. The Dow Jones industrial average gained 282 points, ending the day up 1.8%. The S&P 500 rose 1.4% and the Nasdaq added 1.1%.