It's the last trading day of January and it's off to a positive start thanks to a surprise move by Japan's central bank.

Here are the five things you need to know before the opening bell rings in New York:

1. Japan goes negative, markets go positive: The Bank of Japan is stepping up its efforts to push the country's struggling economy forward by taking interest rates into negative territory.

The central bank announced Friday that it will introduce an interest rate of minus 0.1%, and will go even lower if needed.

In theory, negative rates encourage consumers to save less, and borrow and spend more. They can also weaken a country's currency, helping exporters.

Unsurprisingly, the yen dropped sharply versus all major global currencies on Friday. The interest rate move pushed Japan's key stock market index up by 2.8%.

Related: Japan's master of surprise shocks with subzero interest rates

2. Stock markets surge: The interest rate move in Japan is having ripple effects around the world.

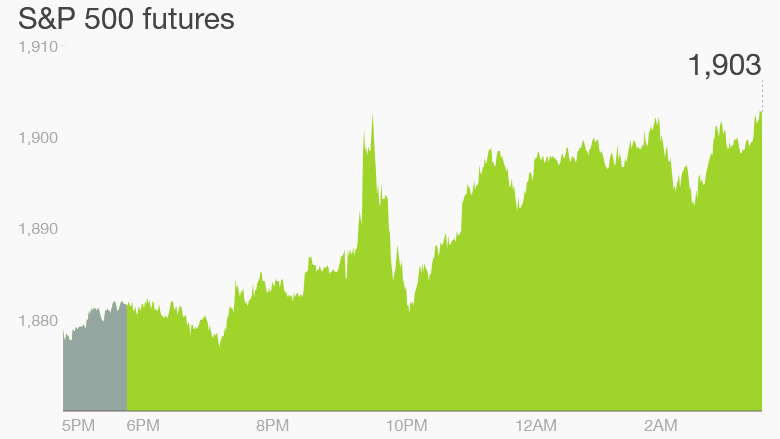

U.S. stock futures are rising by about 1% as investors cheer the latest official effort to pump free money into the financial system.

European markets are also rising by about 1% to 2%. And all Asian stock markets closed the week with gains.

3. Main market movers -- Amazon, Microsoft, Xerox, Sony, Sky: Shares in Amazon (AMZN) are falling by 12% premarket after the company's earnings badly missed Wall Street forecasts.

Shares in Microsoft (MSFT) are rising by about 4% premarket after the tech giant reported better-than-expected quarterly results.

Investors are watching Xerox (XRX) as the company is expected to announce it will split itself into two companies. The firm is also reporting earnings Friday morning.

Shares in Sony (SNE) surged by 6% in Japan after the company reported quarterly results that beat market expectations. The company said strong revenue from its movies and PlayStation 4 helped offset declines in other business units.

Shares in the European broadcast giant Sky (SKYAY) are rising by 2% in London after the company announced James Murdoch will return as chairman in April. It's a job he held from 2007 to 2012. He stepped down amid a massive phone hacking scandal. James, one of Rupert Murdoch's sons, is also CEO at 21st Century Fox (FOX), which owns a 39% stake in Sky.

4. Earnings and economics: Xerox, along with MasterCard (MA), Chevron (CVX), Whirlpool (WHR) and Colgate-Palmolive (CL) are among the long list of companies reporting ahead of the open.

On the economic front, the U.S. government is releasing its latest GDP data for the fourth quarter at 8:30 a.m. ET.

The Russian central bank kept interest rates unchanged at 11%, despite a deep recession that is causing growing discontent among Russians. The ruble is trading near record lows.

Official European inflation data shows prices across the region rose 0.4% in January, which was in line with expectations. Prices rose by a measly 0.2% in December.

Related: Russia is one of the 10 worst economies right now

5. January market recap: It was a crazy, volatile, eventful month in the markets.

The Dow Jones industrial average has fallen by nearly 8%, the S&P 500 is down by 7.4% and the Nasdaq has plunged 10%.