Get ready for a day filled with earnings and volatility.

Here are the six things you need to know before the opening bell rings in New York:

1. Commodity companies lead the way: The markets continue to take their cues from crude oil, which at one point was up about 10% in just 24 hours. Oil prices have since retreated a bit and are hovering around $32 a barrel.

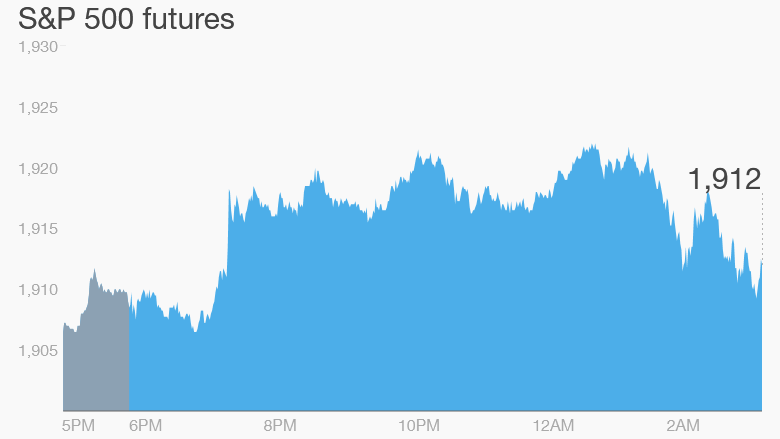

The pullback in oil prices is weighing on U.S. stock futures, which had been pointing higher earlier but are now solidly in the red. European markets are mixed, while nearly all Asian markets ended with healthy gains.

Oil prices spiked 8% on Wednesday after the release of a report by the U.S. Energy Information Administration showing the country continued to stockpile high levels of crude oil. But the storage levels were actually smaller than expected, said Kit Juckes, a global strategist at Societe Generale.

2. Credit Suisse slumps: Shares in Credit Suisse (CS) are plunging by about 11% after the bank reported a dismal set of earnings and said it was laying off 4,000 staff. The Swiss bank lost about $5.8 billion in the fourth quarter as the bank wrote down the value of its global markets and investment banking businesses. This resulted in the bank's first full-year loss since 2008.

3. More earnings: Oil giants Shell (RDSB) and Statoil (STO) reported sharply lower earnings as they struggle with depressed oil prices.

Other energy giants such as ConocoPhillips (COP), Valero (VLO) and Occidental Petroleum (OXY) will issue quarterly updates before trading begins.

New York Times (NYT) and Dunkin' Brands (DNKN) also report this morning.

After the closing bell, the markets will hear from companies including LinkedIn (LNKD), Lions Gate Entertainment (LGF) and News Corp (NWS).

4. Media movers: Shares in Viacom (VIA) and CBS (CBS) could shoot higher when trading begins after CBS announced ailing media mogul Sumner Redstone is resigning as chairman. CBS CEO Leslie Moonves is taking his place.

A similar change may occur at Redstone's other company, Viacom, later this week: Viacom's board is scheduled to meet Thursday.

Activist investors have been pressuring Redstone, 92, to step aside because of concerns about his health.

5. Economics: The U.S. government is releasing a range of employment data at 8:30 am ET. Traders will get to see the latest weekly unemployment claims, along with quarterly productivity data and monthly statistics on worker pay.

6. Wednesday market recap: It was a mixed day on Wednesday. The Dow Jones industrial average added 183 points, ending the day 1.1% higher. The S&P 500 inched up 0.5%, while the Nasdaq dipped 0.3%.