Global stock markets are awash with red, oil prices are dropping and investors are seeking safety in bonds.

Welcome to Wednesday!

Here are the five things you need to know before the opening bell rings in New York:

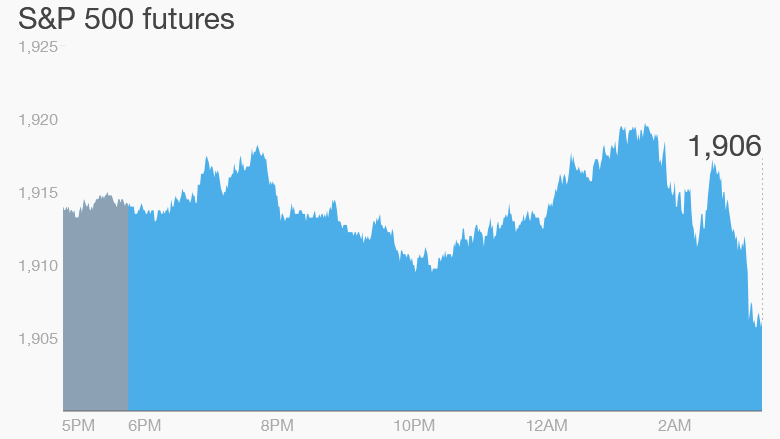

1. Market overview: U.S. stock futures and major global indexes are falling. All major European markets are down by more than 1% in early trading. Nearly all Asian markets ended the day with losses.

Sentiment continues to be driven by fluctuations in crude oil prices, which are falling by 3% to $31 per barrel.

U.S. crude prices dropped about 5% on Tuesday after Iran called Saudi Arabia's plan to freeze production a "joke."

Investors were also discouraged by comments from Saudi Arabia's oil minister Ali al-Naimi. He said it would be a waste of time to seek a coordinated global production cut.

"Not many countries are going to deliver, even if they say they will cut production they are not going to deliver," he said at an energy conference in Texas.

Related: Oil still has a chokehold on stocks

2. Pound gets pounded: The British pound has hit a new seven-year low versus the U.S. dollar over worries the country could vote to leave the European Union. A referendum on the issue is scheduled for June 23.

Many banks and big businesses are urging Britons to vote to stay in the EU because they worry that trade, jobs and investment would suffer if the U.K. goes it alone. Pro-Brexit campaigners argue that the country will do better if it regains control over lawmaking and immigration by leaving the EU.

The U.K. pound is now trading at $1.39.

3. Earnings: A number of big retailers are reporting earnings ahead of the opening bell, including Lowe's (LOW), Target (TGT) and TJX (TJX), which owns the T.J. Maxx and HomeSense chains.

After the closing bell, a large batch of companies will report, including HP (HPQ), Sturm Ruger (RGR), Salesforce.com (CRM), Transocean (RIG) and Victoria's Secret owner L Brands (LB).

4. Economics: Traders will be watching for two important economic reports Wednesday.

New home sales figures from the U.S. Census Bureau come out at at 10 a.m. ET.

The government will release crude oil inventories data at 10:30 a.m. These weekly updates have recently been showing that America is pumping so much oil that it's running out of places to keep it all.

5. Stock market recap: It's been an exciting week in the markets and Wednesday has barely even begun.

The Dow Jones industrial average, S&P 500 and Nasdaq surged by over 1% on Monday but then gave up most of those gains Tuesday.