It looks likes investors are selling out of stocks and putting their money into bonds and commodities right now.

Here are the four things you need to know before the opening bell rings in New York:

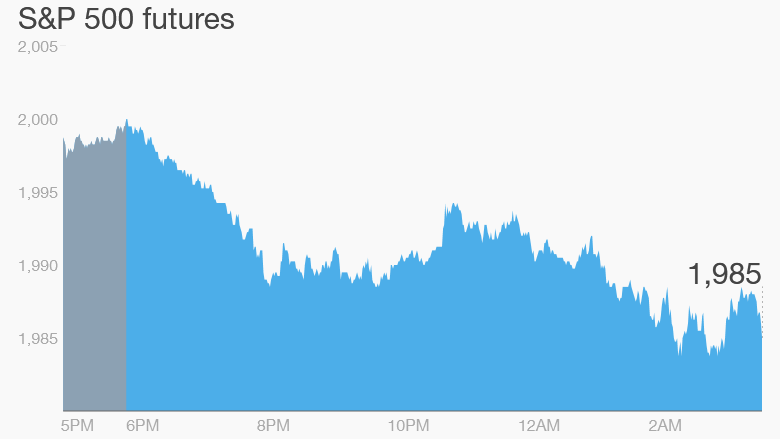

1. Stocks, bonds, commodities: Stocks are poised for a weak trading session.

U.S. stock futures are slipping, many European markets are dipping by over 1% in early trading. Most Asian markets ended the day with losses, though the main Chinese indexes managed to hold steady.

Yields on many 10-year government bonds are slipping as investors shift their money into the debt markets.

In commodities, precious metals like gold and silver are climbing. Gold prices have surged by just over 20% since mid-December as investors sought a safe haven during the recent market meltdown.

Industrial metals like aluminum, copper and nickel are also jumping. Iron ore prices are slipping a tad following a record 17% spike on Monday.

And oil prices are softer, trading just below $38 per barrel.

2. Companies to watch -- Burberry, ZTE: Shares in Burberry (BURBY) are jumping in London as the Financial Times reports that a mystery shareholder has purchased a 5% stake in the trench coat maker. The fashion house is reportedly seeking help from advisers to fend off a possible takeover bid.

The company declined to comment on the issue when contacted by CNNMoney.

The U.S. government is cracking down on Chinese telecom equipment maker ZTE (ZTCOF) over an alleged scheme to dodge sanctions on Iran. It is imposing restrictions that will make it harder for ZTE to acquire U.S. components. ZTE's shares were suspended in Hong Kong, and it's unclear when trading in the stock will resume.

3. Economics: Official data shows the eurozone economy grew by 1.6% in 2015, slightly higher than the preliminary estimate. It is significantly better than the 0.9% growth from 2014. But even as economic activity improves, deflation continues to plague the region.

China's trade numbers are in the spotlight Tuesday after data showed exports shrank by 20.6% in February compared to the previous year.

China's economy is now registering its slowest pace of growth in 25 years after decades of breakneck expansion.

Related: The hottest stock markets in the world right now

4. Monday market recap: Monday marked the fifth consecutive day of trading gains for the Dow Jones industrial average and S&P 500. Both indexes are up by more than 3% over the course of the rally.

However, the Nasdaq edged back on Monday by 0.2%.