Cash-strapped oil companies are officially in scramble mode.

U.S. oil and gas companies are trying to survive the crash in oil prices by selling stock to investors at a record-setting pace to raise cash.

The wave of additional stock sales from these publicly-traded companies highlights the enormous amount of stress and fear in the oil patch right now. Cheap oil has already forced drilling and exploration companies to dramatically cut costs by laying off workers, shelving expensive projects and even ditching their coveted dividends.

With oil prices stuck below $40 a barrel, companies are racing to quiet bankruptcy fears. And to do that they have to raise cash -- fast. The preferred method usually is to sell bonds. But that's not an option for many companies that are already loaded up on too much debt taken on during the good times.

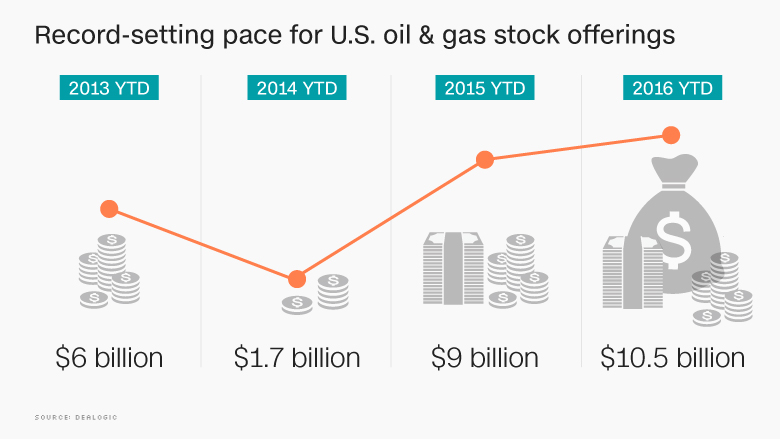

That's why the latest trend in the oil patch is to raise money by selling extra stock. U.S. oil and gas companies have already sold $10.5 billion in new shares so far in 2016, according to Dealogic. That's the most for this time of the year based on Dealogic records going back until 1995.

"The worse your balance sheet looks, the fewer opportunities you have to fix things. You do what you have to do," said Jeff Schlegel, co-head of the global energy practice at the law firm Jones Day.

Related: $20 billion erased from Exxon's spending budget

Last week Marathon Oil (MRO) joined the parade of stock offerings, raising $1.3 billion. The stock sale came just weeks after the company reported its first annual loss in 20 years. Marathon has sought to stem the bleeding by cutting its capital spending in half for 2016.

At least 16 other American oil and gas companies have done the same thing this year, including Hess (HES), Devon Energy (DVN) and Weatherford International (WFT). This week Gulfport Energy (GPOR) announced plans to raise $358 million by selling 14.7 million shares.

Schlegel said he expects this trend to continue given the limited options right now.

During the boom years, investors let oil companies borrow huge sums of money relatively cheaply. However, the crash in oil prices has sent ripples through the credit markets and limited the appetite for junk bonds -- especially from energy companies. Bankruptcies among U.S. oil and gas companies spiked 379% last year and they're expected to stay elevated.

"There are always going to be bad bets. It's just the nature of the beast," said Schlegel.

Related: Big Oil's fat dividends are under siege

Asset sales may not be a great option right now either. With oil prices this low, there's not much demand for rigs or equipment, nor does anybody want to sell at fire sale prices.

Stock offerings represent a double-edged sword for investors. The bad news is they dilute the holdings of existing shareholders, who suddenly find out they own a smaller amount of the same company.

However, none of the companies have found it that hard to raise the cash. The fact that they have been able to raise nearly $11 billion through stock offerings represents a vote of confidence in the long-term future of the industry.

The big positive is that raising cash lowers the chances of a bankruptcy. So even if shareholders are seeing the value of their holdings diminish in value, a bankruptcy would be far worse. It would bring the value of their investment to zero.

Maybe that's why shares of Marathon, Weatherford and others rose after they pulled off stock offerings.

"Investors want confidence the company is not going to have a significant crisis in the near-term. That's what the market is rewarding right now," said Brian Youngberg, senior energy analyst at Edward Jones.