Central banks are starting to lose their magic on the markets.

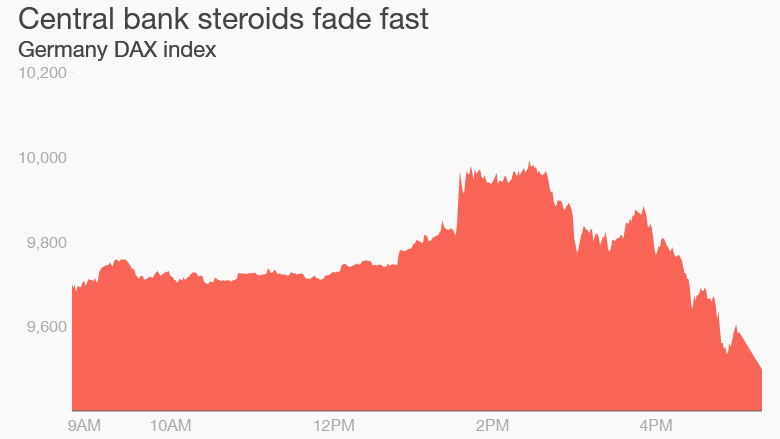

The European Central Bank on Thursday announced a steroid-filled stimulus program in an effort to boost the European economy. European stock markets rallied sharply in response. But within an hour, almost all European markets turned south and soon were in the red.

It's almost as if investors have stopped believing that central banks have what it takes to turn around economies.

"I get the initial market euphoria...but I very much question the lasting nature of it," says Peter Boockvar, chief market analyst at the Lindsey Group.

Related: ECB pulls out all the stops

Maybe it's because investors are realizing that aggressive actions from central banks can't really achieve their goals anymore. Moves that once sparked bull markets are now having little impact.

In fact, investors seem to be giving central banks a thumbs down lately.

Japan's central bank in January surprised everyone by introducing negative interest rates in hopes of creating demand in its economy. Its benchmark stock market index, the Nikkei 225 rose immediately. And the yen fell against the dollar on hopes that this move would stimulate exports.

But six weeks later, Japan's Nikkei 225 index is down and its currency has gained value against the dollar.

"Markets have not gone up with negative interest rates. The reason is negative rates are bad for the banking system," bond king and billionaire investor Jeff Gundlach said on a conference call Tuesday.

Related: Global central banks are running out of ammo?

The ECB too first introduced negative interest rates on June 5, 2014. Since then, Europe's Stoxx 50 index is actually down 5%. Germany's DAX and France's CAC are also lower.

The U.S. Federal Reserve was the first central bank to aggressively use monetary policy to juice up the economy. It cut rates down to zero in 2008 and started a massive bond-buying program known as quantitative easing or QE. That did boost markets tremendously at first.

But the more the Fed juiced the markets, the less impact it had. During the Fed's first round of QE between December 2008 and November 2010, where it bought bonds and mortgages, the S&P 500 shot up 33%.

The market didn't rise much during the QE2, and did rise considerably during the QE3, but not as much as the first round.

Now central banks are finding that they can't get markets excited even for a few hours.